MADISON, Wis. — Entrepreneurs across the Badger State will be able to tap into some big help thanks to Wednesday’s launch of the Wisconsin Investment Fund.

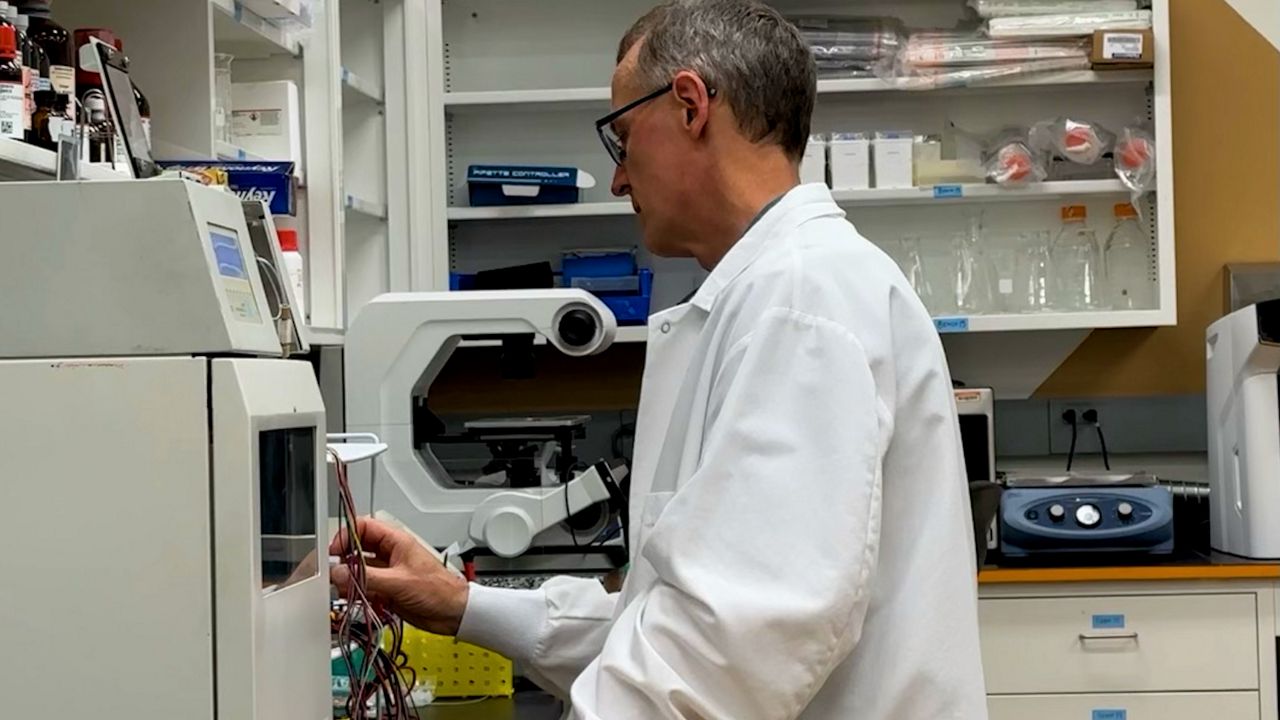

During a visit to Forward BIOLABS in Madison, Gov. Tony Evers and Wisconsin Economic Development Corporation (WEDC) Secretary and CEO Missy Hughes announced an initial $100 million investment to help startup businesses throughout the state, which is a part of a public-private initiative.

The focus of the partnership will be on tech, agriculture, manufacturing, and biohealth. Officials from five venture capital firms, who will administer the first round of fund investments, joined the governor and secretary for Wednesday’s announcement. A sixth capital management firm is expected to be announced soon.

“As the business that receives these investments starts to grow, the value of the fund will grow with them, and this will create new opportunities to help even more businesses expand,” Gov. Evers said.

Each of the firms must match every dollar of public funds with at least one dollar of private money. Doing so will double the impact of the state’s investments, the returns on which will be reinvested into the fund to build more capital and help more companies get off the ground.

“We’re going to go to our rural areas, to our cities, to make sure that we are making this fund and these dollars accessible to entrepreneurs in every community in Wisconsin,” Hughes added.

At least $27 million of the state’s investment will be allocated toward the biohealth sector. Wisconsin was designated as a Regional Technology Hub last year, which makes the state eligible for $75 million in new federal funding to help speed up the research and development of new treatments.

As part of a competitive bidding process, the Wisconsin Investment Fund committee reviewed 31 applications from fund managers and selected the final firms:

- $15 million for Madison-based HealthX Ventures

- $12 million for Venture Investors Health Fund in Madison and Milwaukee

- $7 million for Serra Ventures projects in Wisconsin

- $6 million for NVNG Investment Advisors based in Madison and Milwaukee

- $5 million for the Idea Fund of La Crosse

WEDC is currently negotiating with the sixth fund manager for the investment fund’s remaining $5 million allocation.