WASHINGTON, D.C. — “Denied.”

Many patients are confused and frustrated after getting a health insurance claim rejected for care prescribed by a doctor. Now one Ohio lawmaker is proposing legislation to bring down spurious claim denials.

What You Need To Know

- Twenty percent of all claims made on Affordable Care Act (ACA) health insurance plans are initially denied, according to a Kaiser Family Foundation survey

- Because less than 1 percent of denied claims are appealed, health insurance industry analysts said insurance companies have been incentivized to deny legitimate claims

- Sen. Bernie Moreno, R-Ohio, proposed legislation to impose a 25 percent penalty on health insurance companies for claims that are successfully appealed

Claim denials are a top issue for patients. Twenty percent of all claims made on Affordable Care Act (ACA) health insurance plans are initially denied, according to a Kaiser Family Foundation survey.

ACA health insurance plans cover only about 10 percent of Americans. Though data is harder to find on private health insurance plans, recent surveys suggest denial rates are rising.

When patients appeal, they win nearly half the time. Yet because less than 1 percent of denied claims are appealed, health insurance industry analysts said insurance companies have been incentivized to deny legitimate claims.

“It’s this balancing act, right? I think a lot of doctors would say that the practice has become exploited by the health plans to limit the amount they have to pay out in claims,” said Sabrina Corlette, research professor at Georgetown University and founder of its Center of Health Insurance Reforms. “When you talk to the health plans, they will say, ‘No, we have to do this to keep costs down and keep premiums from being too high.’”

Patients are not the only ones paying more due to denied claims. Hospitals and other providers that fight claim denials spend about $43.84 per claim, according to a survey by healthcare company Premier. Considering that health insurers process about three billion medical claims each year, providers spend about $19.7 billion a year on claim reviews.

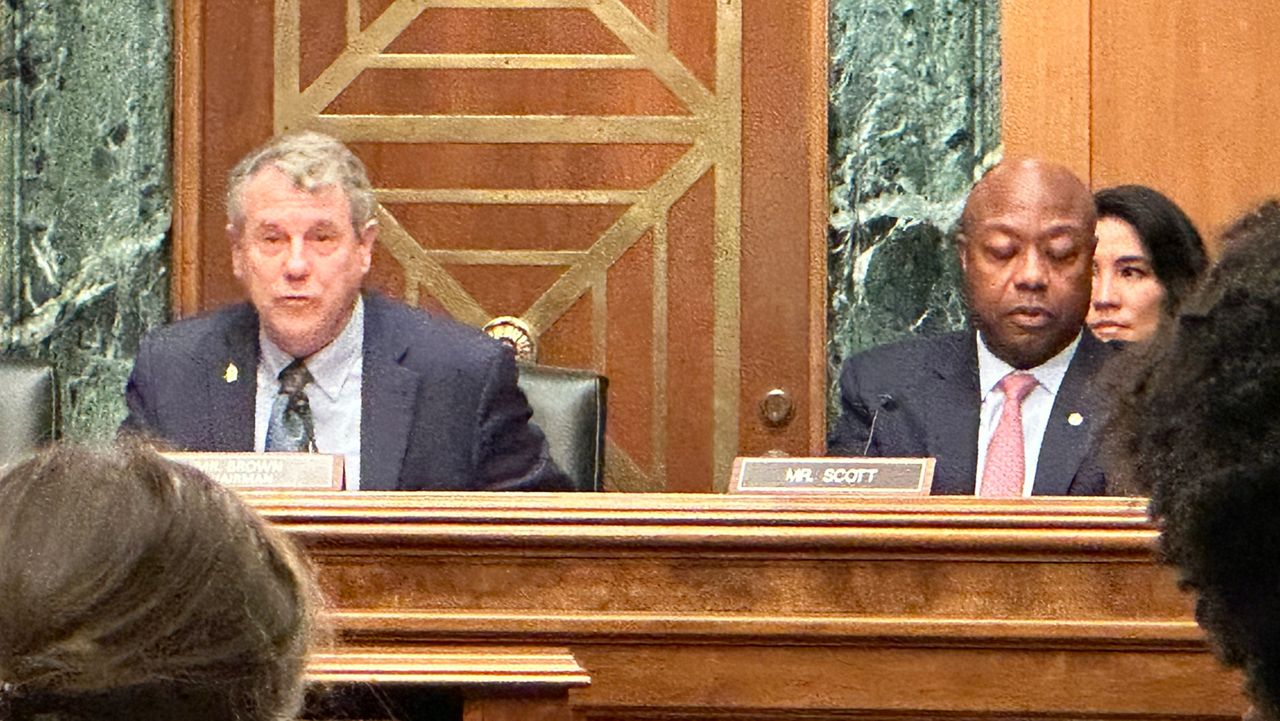

Sen. Bernie Moreno, R-Ohio, recently mentioned a plan to disincentivize spurious denials by charging a 25 percent penalty on denied claims that are successfully appealed.

“My point of view is very simple. You want to play a game, you're going to pay a price. I think that 25% will change behavior pretty quickly. So we’re going to work on introducing legislation to do that,” Moreno said.

Corlette said she was encouraged by Moreno’s attention on the issue, but that a penalty would likely fall on employers who sponsor healthcare plans rather than the insurance companies themselves.

Instead, she advocated reforms such as requiring greater transparency on denials, more clarity around clinical standards and creating a list of health categories that should never require prior approval.

Another idea she mentioned was a “gold card” program some insurance companies allow certain providers to charge for some health services without prior authorization from the insurance company.

Passing federal legislation to extend patient protections over private health insurance companies would be difficult; the last major such law was the ACA in 2010. However, recent events like the targeted killing of UnitedHealthCare CEO Brian Thompson last December have raised calls to reform the health insurance industry.