LOUISVILLE, Ky. — Voters in Jefferson County will cast their ballots this year for president, a United States senator, state and local lawmakers, two constitutional amendments, and whether to raise their property taxes to benefit public schools.

The “Tax Levy Question,” as it’s called on the ballot, reads as follows:

Here’s everything you need to know about the proposed increase:

The proposal calls for an increase in property taxes from the current rate of 73.6 cents per $100 in assessed value to 80.6 cents. This means property owners will pay an extra $70 per year for every $100,000 in assessed value.

Jefferson County Public Schools has a tool that allows property owners to see how much the proposed tax increase would affect them.

As for how much the increase will raise, the Board of Education has estimated adding roughly $54 million to its budget in the first year of the increase, should it pass.

Speaking at Valley High School a month before Election Day, JCPS Superintendent Dr. Marty Pollio said the tax increase is an investment in the success of Jefferson County students. “When communities step up and fund their public schools, student outcomes and student achievement increase dramatically,” he said. JCPS says the increased revenues would help it execute its plan to raise the proficiency level in math to 70 percent, up from 35 percent; raise the proficiency level in reading to 75 percent, up from 44 percent; and cut the achievement gap in half.

A document laying out the “case for new investment” highlights eight needs the district has, including building new facilities and repairing existing ones, raising teacher pay, and providing essential wraparound services for homeless, English-learning, and special needs students.

The document also provides some context for why the tax increase is needed. Frankfort has cut JCPS funding in recent years, resulting in a $42 million loss since 2015. Meanwhile, JCPS remains well behind some of the state’s other large school districts when it comes to facility investment. “In just the past decade, Fayette County has built 10 new schools,” according to the document. “JCPS has built one.”

In September, the Jefferson County Board of Education passed a resolution outlining its plans for the estimated $54 million:

- At least $15 million for 21st century facilities that engage students and faculty

- At least $15 million for resources in our highest-need schools

- At least $12 million for racial equity initiatives

- At least $12 million for additional student instructional time

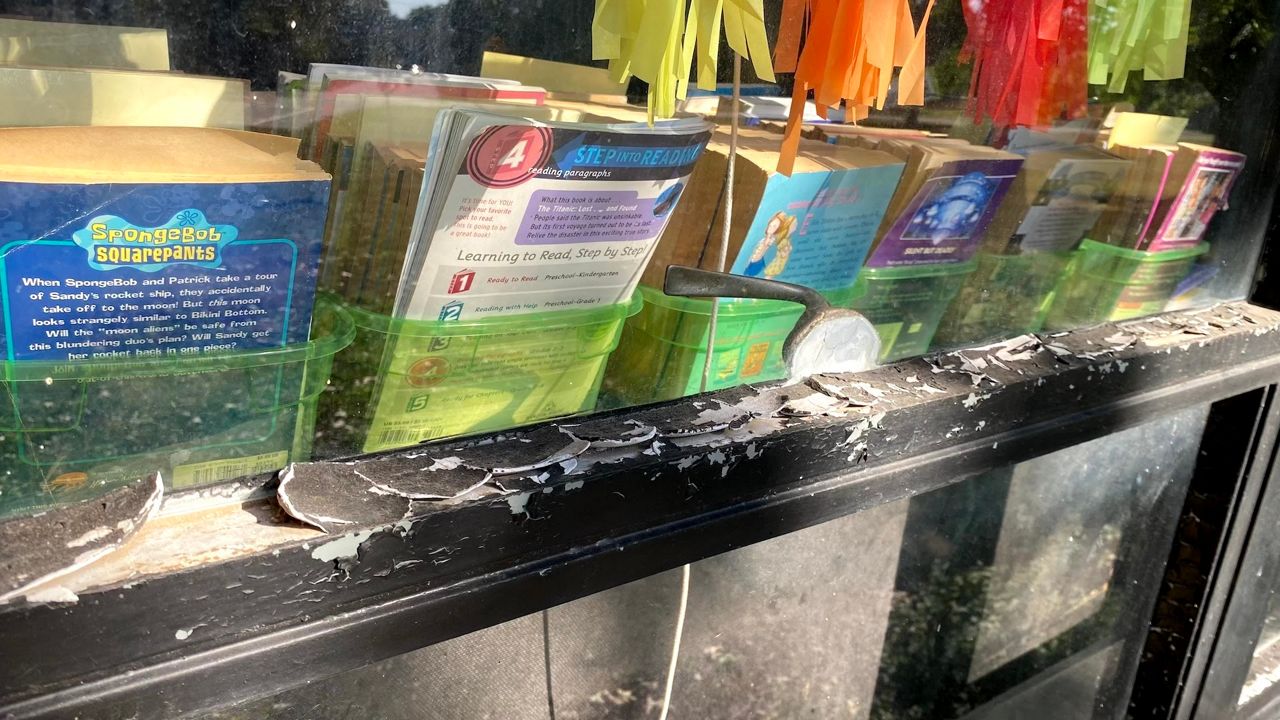

According to JCPS, nearly 30 of its schools have “end of life” facilities. Teachers at some schools report holes in walls, leaky pipes, and HVAC systems that can't keep up with the late summer heat.

The district also wants to build new schools to accommodate a new student assignment plan that would allow many students in West Louisville to attend school closer to their homes.

A group of local business and community leaders has formed a group called Yes 4 JCPS that is advocating in favor of the increase. On its website, the group says the increase will “allow JCPS to improve resources for all students, especially those who have not gotten a fair share.”

Among the groups asking people to vote in favor of the increase is Greater Louisville Inc., the city’s chamber of commerce. In a Courier-Journal op-ed, GLI president Sarah Davasher-Wisdom wrote that “committing to continued, and even accelerated, investment in public education” is what Louisville “needs for a successful future.”

At least 38,507 people. That’s how many signatures opponents of the tax increase collected earlier this year in their attempt to put the matter on this November’s ballot. It was nearly 3,000 more than they needed.

The petition was started by conservative activists who argue that JCPS is already well-funded and blame “highly paid administrators” and a lack of leadership for the district’s problems.

Louisville Tea Party President Theresa Camoriano, who led the movement, said this summer that people can’t afford a tax increase during the pandemic. Rather than increase funding, she said, “one of the most important things they need to do is to require everyone in the system to treat everyone with respect."

There is some confusion over the phrasing of the question, which asks if you are “for or against” the tax increase, and provides two bubbles to fill in reading “yes” and “no.” A "yes" vote is a vote in favor of the tax increase and a "no" vote is a vote against it.

The Board of Education could still increase taxes, but by a smaller amount. State law allows local boards to raise revenue by four percent without the possibility of a recall vote. The increase on this year's ballot would result in a nine percent increase. That’s why opponents were able to gather the signatures to put it up for a vote. Even if that vote fails though, JCPS still has the authority to tack on a four-percent increase.