LOS ANGELES — Now that Congressional leaders have agreed upon $908 billion in COVID relief spending, the clamoring has begun for pieces of the pie in Southern California. Whether it’s a restaurant teetering on the edge of survival, a renter on the verge of eviction, or a single mom with young mouths to feed, the need for the money is great. Here’s a look at the impact the stimulus funds are likely to have in the Greater Los Angeles area.

The federal stimulus plan includes an additional weekly unemployment benefit of $300 through March 14. It also extends the Pandemic Unemployment Assistance program that provides federal unemployment benefits to contract and gig workers, as well as the Pandemic Emergency Unemployment Compensation program that adds additional weeks of federal unemployment to individuals who’ve run out of their state unemployment benefits.

Due to COVID, unemployment in California is almost double what it was a year ago. According to the U.S. Bureau of Labor Statistics, 8.2% of Californians were unemployed in November, compared with the national average of 6.7%. The leisure and hospitality industries have seen the largest losses, shedding 490,000 jobs between November 2019 and last month, according to the California Employment Development Department.

Only 50% of leisure and hospitality jobs have been recuperated since the pandemic began in March, said Chapman University Economics Professor Raymond Sfeir, so the additional unemployment benefits are “desperately needed,” he said.

The question is whether they will be enough to see people through to an economic recovery that most economists don’t see happening until at least the summer once vaccines become more widely available.

While the stimulus will make the first six months better than they would have been otherwise, "the first half of 2021 is not going to be a very good half," Sfeir said, "particularly the winter months, especially in L.A. and Orange Counties with the number of infections and people in hospitals. The situation is really bad.”

The COVID relief bill will provide $600 stimulus checks for individuals earning up to $75,000, as well as $600 per dependent child for qualifying families, but that money won’t go as far as it does in other parts of the U.S. California has the second-highest cost of living in the country, following Hawaii, according to the Council for Community and Economic Research.

“It’s not clear that with $600 people can survive until the summer,” said Laura Gonzalez, associate professor of finance at California State University, Long Beach.

“Eventually we are going to need a plan, and that’s what the new administration is communicating: that they have a plan to put people back to work and build the new future. We will have to move very aggressively.”

The stimulus package includes $25 billion in emergency assistance to renters. It also extends the moratorium on evictions that was set to expire at the end of the year through January 31.

“In California, we have a problem with renters,” Gonzalez said, adding that more than half of the households in L.A. rent rather than own their homes, due to the state’s high housing costs, and that a third of those renters are at risk of eviction due to COVID.

The median home price in Southern California in October was $605,000, according to DQNews — a 14% increase from the year prior. The average rent for an apartment in Los Angeles is $2,375, compared with $1,464 nationally, according to RentCafe.com.

Gonzalez anticipates that “a substantial amount” of the feds’ rental relief stimulus will come to California because of the state’s housing affordability crisis and higher-than-average unemployment.

“It’s going to be more critical because home ownership is lower and the rental expenses are higher than in other areas of the country,” she said.

The extension of the eviction moratorium, she added, “was essential. Otherwise, we were going to have a catastrophic end of the year here.”

Universe Holdings CEO and Chairman Henry Manoucheri said the COVID-19 relief bill is long overdue.

"It would have been nice to have seen this in July or August. A lot of businesses closed, and people suffered because partisan politics upheld this," Manoucheri said.

Manoucheri owns 3,000 apartment units, mostly in Southern California. He said the pandemic has been challenging as a landlord. His company has helped many of his tenants find rental assistance through various city and county programs. While most of his tenants paid on time, those who couldn't were placed on a payment plan. In some cases, with balances building up, he's asked tenants who couldn't pay to leave their units and have their debts forgiven.

"It's sort of like a buyout for tenants," Manoucheri said. "This has been extremely challenging. It used to be a fun business, and it's not fun anymore."

Manoucheri said the new rental assistance program and more money for the unemployed would keep people housed in their apartments.

But there are concerns that not enough is being done for housing providers.

“I am hopeful the $25 billion of federal funding will help keep renters and housing providers alike ‘going,’” said Daniel Yukelson, with the Apartment Association of Greater Los Angeles. “Unfortunately, 100s of billions in rental debt may have accumulated today, and for some housing providers, this money may be arriving far too late. Unfortunately, $25 billion is a mere drop in the bucket. But, every bit helps, and we cannot kick a gift horse in the mouth.

The relief package includes $284 billion for Paycheck Protection Program loans, as well as adjustments to the program to help independent restaurants, small businesses, and nonprofits.

The new program will provide a second round of access to PPP loans as well as larger loans. The PPP will provide a business with a forgivable loan based on 2.5 times its monthly payroll costs; restaurants can also seek forgivable loans based on 3.5 times their monthly payroll costs. Companies that employ 300 or more people at all of their locations combined are not eligible.

Restaurants have been hit especially hard by COVID restrictions that, most recently, have prevented eateries in L.A. and Orange Counties from in-person dining. Roughly one in six, or more than 110,000 restaurants, have closed either permanently or long term, according to a December poll from the National Restaurant Association.

“We were hoping for more, but we are grateful for this and hoping the distribution can happen quickly as some restaurants are hanging on by a thread,” said Pam Waitt, president of the Orange County Restaurant Association, which represents 800 dining establishments. “Everybody is struggling. This is massively welcome relief.”

Tropicana Inn & Suites General Manager Greg Eisenman said the new COVID-19 relief bill couldn't have come at a better time. Since the pandemic began, the Tropicana Inn & Suites and neighboring hotel Camelot Inn, as well as other hotels in Anaheim's Resort District, have fallen on hard times.

Eisenman said with Disneyland's theme parks closed, they've been able to make do with the first round of PPP, but that money ran out a couple of months ago.

"We were running on fumes," Eisenman said.

In December, when the governor issued a tighter and more stringent stay-at-home mandate and ordered that only essential workers stay at hotels, the Tropicana averaged a 1% occupancy rate, or three rooms per night out of 300 rooms.

They were ready to close their doors until a new relief package came out.

"We are so relieved," Eisenman said. "We were days away from shutting down the hotel completely. We were planning to lay off our 30 employees and fence up the property. This will give us another shot in the arm and keep our employees employed for another four months."

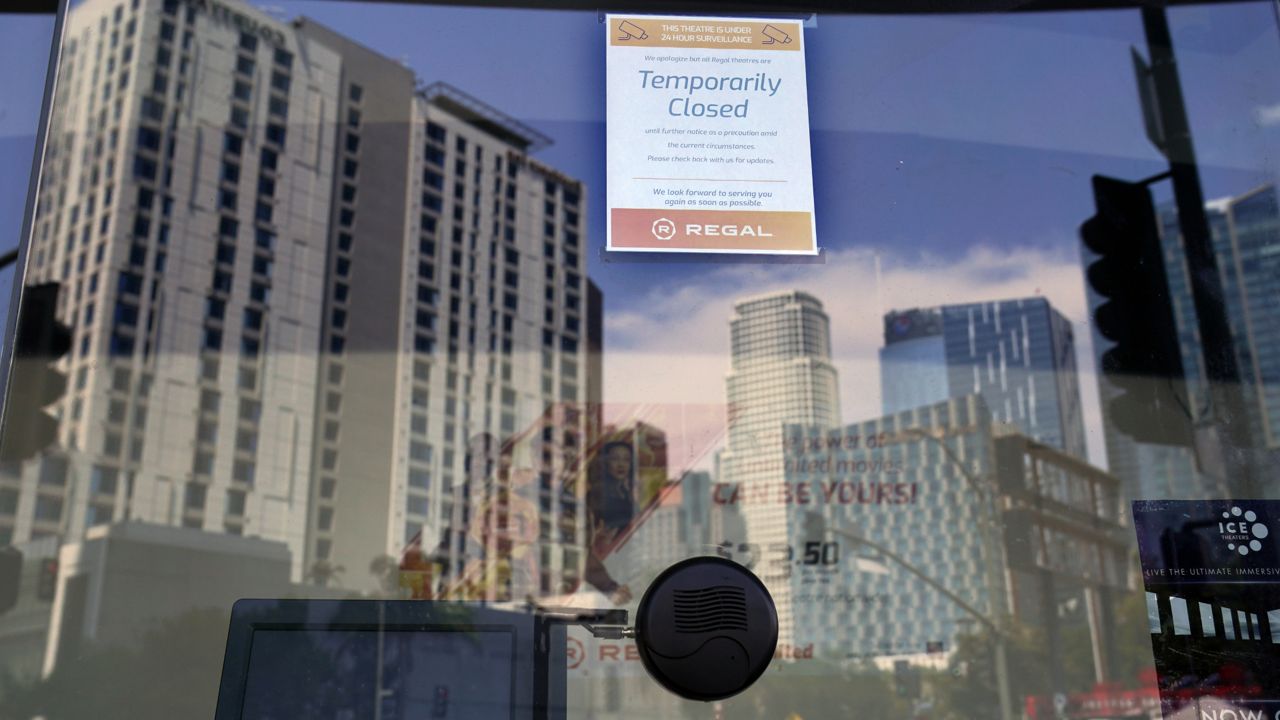

The stimulus package includes $15 billion for independent movie theatres, live entertainment venues, live theater, and cultural institutions.

That aid consists of grants that are tied to the amount of revenue that was lost between April and December 2020 compared to the same period in 2019. The grants will pay up to 45% of that loss, according to Patrick Corcoran, vice president of the National Assn. of Theatre Owners. Companies or institutions that have the greatest percentage loss are first in line.

“For independent theaters in L.A. that have been shut down completely since March, this will mean substantial funding that will help pay their bills and keep them going until the industry returns to strength sometime in the spring,” he said.

The grants are capped at $10 million per entity and are available to companies that fall into two or fewer of the following categories: they have theaters in more than 10 states, theaters in more than one country, or more than 500 full-time equivalent employees. Public companies or companies that receive more than 10% of their revenue from the federal government are excluded.

“Fingers crossed that this will provide needed support,” said Gregory Laemmle, co-owner of the Laemmle Theatres chain that has been in business since 1938. Its seven Southern California theaters have been temporarily shuttered since March. “After being completely shut down for nine months, the need is great.”

California museums are also facing dire financial realities. The California Association of Museums estimates its members are collectively losing more than $22 million per day due to the statewide quarantine. In early April, only weeks after the original statewide stay-at home order, 40% of California museums had cut personnel costs with staff furloughs and layoffs, decreasing the California museum workforce by 10%, according to an association statement.

"It is assumed that the rate of furloughs and layoffs will only continue to increase as museums remain closed in California or open with limited capacities unless further assistance is provided," said CAM spokesperson Celeste DeWald.