WAUKESHA, Wis. — Gov. Tony Evers started his week by signing a bipartisan bill that aims to save working families money when it comes to costly child care.

In its simplest form, Assembly Bill (AB 1023), now Act 101, expands the current child and dependent care tax credit from 50% to 100% of the federal credit.

The goal is to reduce the tax burden for Wisconsin families who are struggling to afford the high cost of care for both children and adult dependents.

“Now, I also want to be clear today—this bill alone will not solve our state’s looming child care crisis,” Gov. Evers told the crowd gathered at La Casa de Esperanza for the bill signing ceremony.

Though the moment was worthy of celebration for the governor, he was a little cautious as he called for more compromise.

“So, I’m willing to work with anybody in the Legislature, across the aisle [or] in my own party, to find a long-term solution to our state’s looming child care crisis,” Gov. Evers added.

Wisconsin Department of Revenue Secretary Peter Barca said under the new law, more than 110,000 taxpayers across the Badger State will save an average of $656 per filer, which amounts to $73 million in annual tax relief.

Barca believes that will have a quadruple effect.

“It’s a benefit for small businesses and the workforce,” Barca explained. “It’s a benefit, as the governor said, for families. It’s a benefit for children, and it’s a benefit for daycare providers whose parents can now better afford to put their kids in daycare.”

For Republicans, who spearheaded the bipartisan proposal similar to what the governor pitched in his budget last year, the moment was bittersweet.

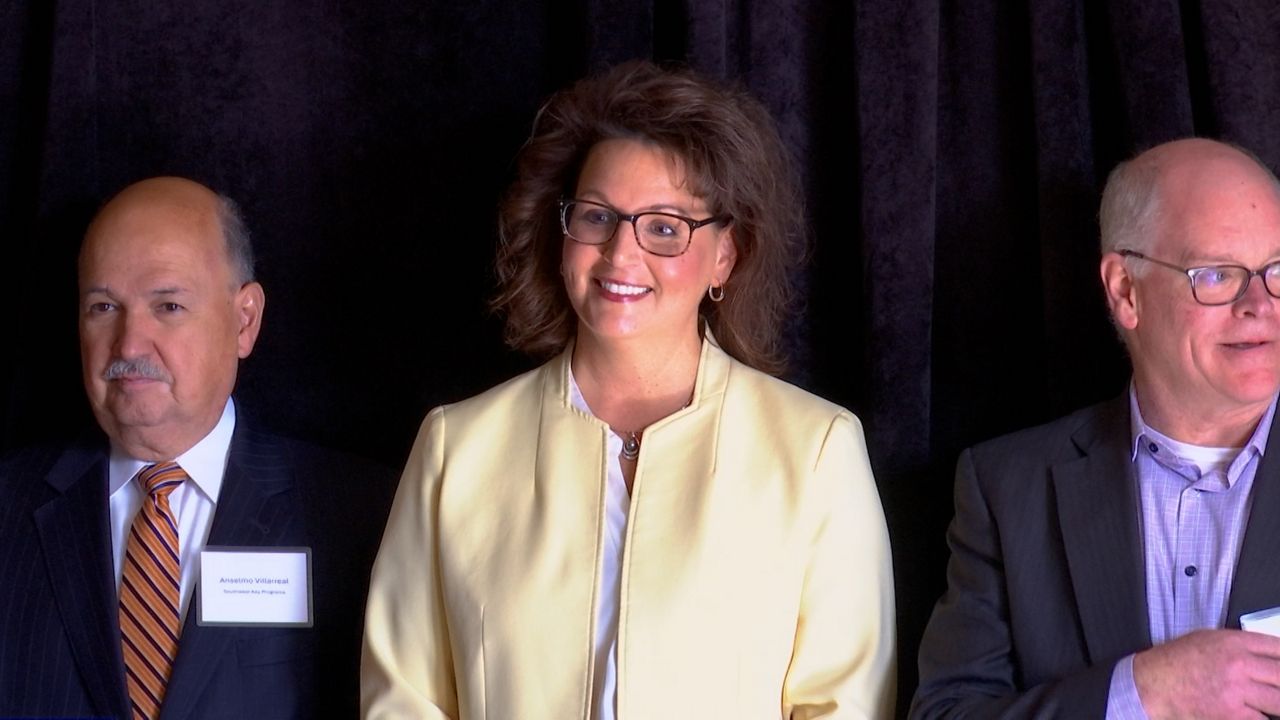

“I’m feeling great. I think this is a great day for Wisconsin, a great day for our families,” State Rep. Amy Binsfeld, R-Sheboygan, said. “[I'm] a little disappointed with the three vetoes last week."

Last week, Gov. Evers vetoed three other tax relief bills passed by Republicans, including a nearly $800 million income tax cut.

Following Monday’s press conference, the governor said he has two main reasons for doing so: first, he felt the cut could have cost the state its surplus, and left no money to pursue other child care-related initiatives, including subsidizing providers. Secondly, Evers said the state may have been obligated to return some of the funds it received for pandemic relief to the federal government.

Republicans have outwardly shared their skepticism, especially over federal funding, insisting that the Biden administration would not make the state pay that money back.