MADISON, Wis. — The pause on monthly federal student loan payments and interest accrual is over.

After three and a half years, more than 700,000 Wisconsinites saw their loans begin to accrue interest on Sept. 1. Monthly payments begin again on Oct. 1.

This comes after the U.S. Supreme Court struck down President Joe Biden’s federal student loan forgiveness plan in June. Wisconsin’s Department of Education estimates 685,000 people in the state applied for that program.

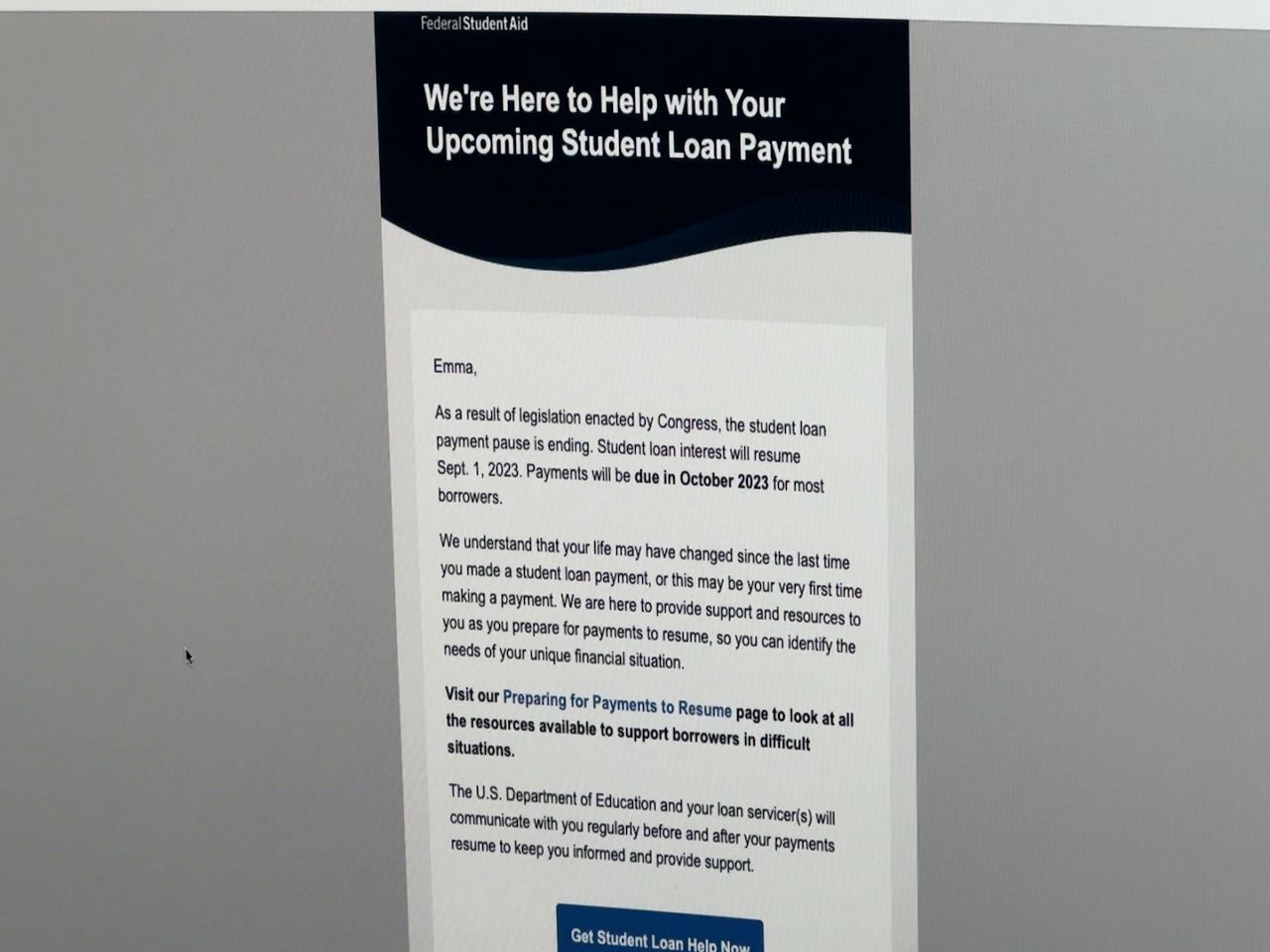

“Especially as someone who grew up low-income on food stamps and I went to school on the Pell Grant, it would’ve been huge,” said Emma Crawford, a financial planner in Madison who also has student loans.

Crawford worked her way through college to pay down her student debt from roughly $40,000 to now just under $21,000. Biden’s plan would have left her with only $850 to repay.

“I remember jumping up and down when I heard that this forgiveness plan initially might have been a reality,” she said. “Honestly, even now, it’s just total disappointment.”

Crawford said she does not support the U.S. Supreme Court’s decision.

“It really hurt that there was no hope left,” she said. “I’m especially concerned about people who can’t afford their monthly payments.”

Natalie Zebian lives in West Allis. Her student loans story is similar to Crawford’s.

She worked her way through college at the University of Wisconsin-Milwaukee and paid off her student debt about seven years ago. She also has a background in finance.

“I hunkered down and really made a plan to pay off these loans,” Zebian said, adding that she had about $30,000 in loans upon graduation. “I made a lot of sacrifices and had to say no to a lot of things.”

Zebian said she supported the decision to block Biden’s loan forgiveness plan because of the burden taxpayers would have to take on.

“Having the government just wipe out people’s student loans and putting the burden back on everyday people, I don’t think that’s the best solution,” Zebian said. “We’d be paying for that on the backend with inflation and higher taxes.”

Despite Zebian and Crawford’s opposite stances, they both agreed on one thing. They said something needs to be done to address the student debt issue and climbing interest rates.

“Where did the problem actually start, addressing the root cause and figuring out who is at fault for these things,” Zebian said. “If we don’t hold the right people accountable, is this going to keep continuing and will we continue to just have bailouts?”

“We need to address the root causes, but why can’t we do both?” Crawford said. “We can pass this debt relief program and get to work addressing the bigger root problems we’re experiencing as a country.”

Many private colleges across the state began the fall semester at the end of August. Universities within the UW System began classes on Sept. 5 and 6.