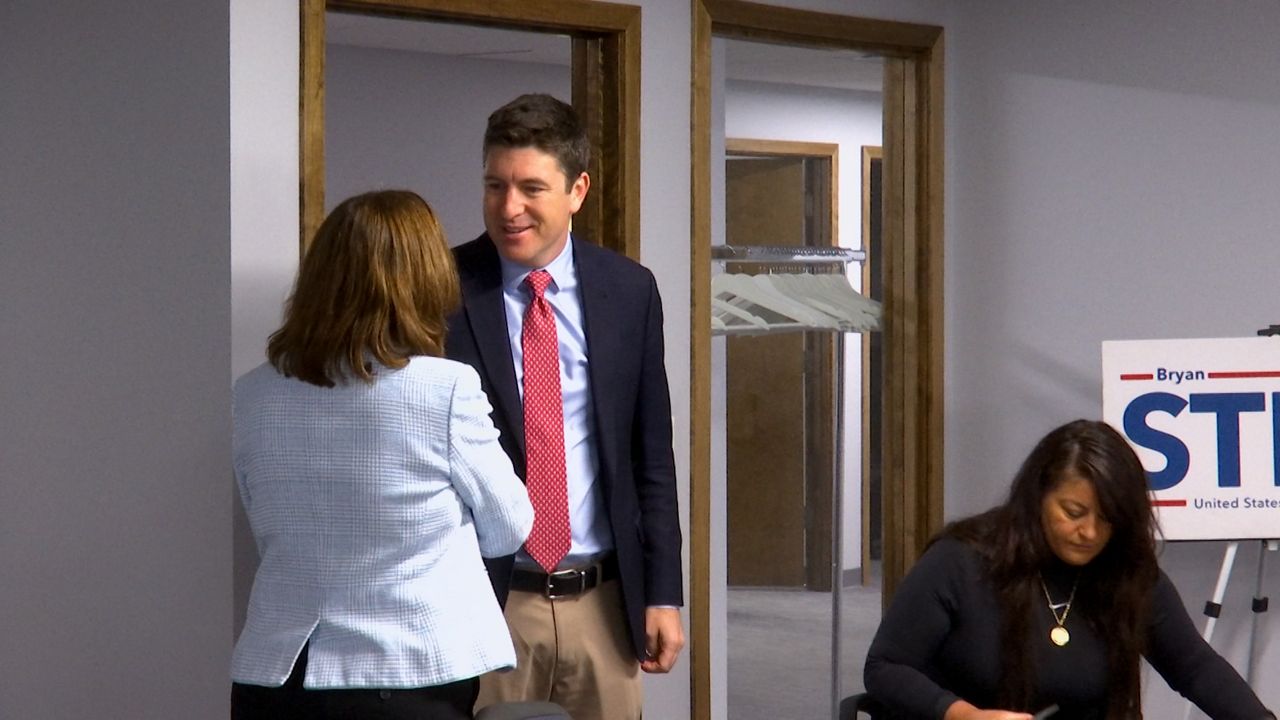

OAK CREEK, Wis. — In the aftermath of the Silicon Valley Bank collapse, and climbing interest rates, Rep. Bryan Steil tried to get a sense of how Wisconsin families are doing during a roundtable Monday.

Interest rates and inflation have become a double-edged sword, especially for those in construction and trades, as they have struggled with a labor shortage. To retain the employees they do have, some companies have raised wages. However, if the market drops off, businesses are worried they won’t be able to keep paying their people.

“We have people sitting with land and plans, but they can’t build because of the interest rates, so they basically have to save more money or wait for rates to come back down,” Jason Cyborowski, president of J&J Contactors, explained.

Interest rates aren’t the only problem. Inflation has played a significant role too.

Some building material suppliers are concerned more residential projects will drop off as costs get passed on to consumers.

“I’m having stone delivered just not even five miles down from [my] shop, and they are charging $180 a slab to be delivered, and that is to cover costs,” Lena Dardha, who owns Wisconsin Granite Design, said.

Builders aren’t alone. Bank leaders said their retail mortgage divisions have dramatically slowed down too.

“The size of home that people can afford has reduced because of interest rates going up,” said Tri-City National Bank CFO Bryan Johnsen. “And so, you just can’t buy the same home today, at these rates, with the same income that you could last summer or two summers ago.”

For Rep. Steil, who sits on the House Financial Services Committee, feedback like that tells him lawmakers in Washington, D.C. need to change course.

“The number one job we need to do is bring costs down and tame inflation,” Rep. Steil said. “How do we do that? I think there [are] three key things we can do. One: we can stop reckless spending, two: we can unleash American energy, and three: we can work to get workers back to work.”

After Monday’s roundtable, Rep. Steil said Wisconsinites should know their money is safe because banks and credit unions are federally insured up to $250,000 per depositor.