MADISON, Wis. — Emma Crawford flipped through a scrapbook, while sipping her coffee on an early Tuesday morning.

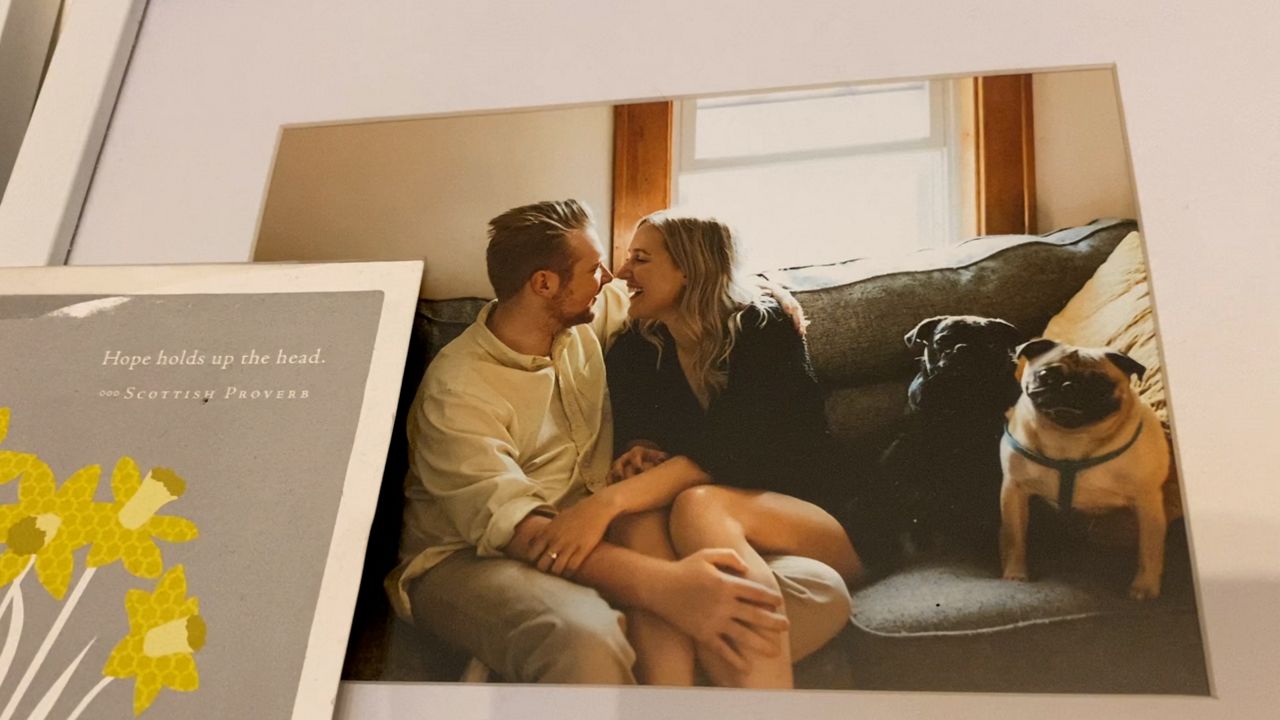

All was quiet in her Madison apartment, except for the faint snore of her two pugs sleeping on the couch. Soft jazz played in the background.

Crawford, 30, pointed to a picture of her and her fiancé. It’s one of her favorite pictures in the scrapbook he made for her.

“That’s when he proposed,” she said with a smile.

The two purchased a house last year and Crawford has been saving up for their wedding later this year. She prioritized that during the student loan repayment pause these past two years.

“I chose to start saving for retirement as well,” she said.

Crawford reflected on having a home, a fiancé, and a career at the age of 30. She knows she’s fortunate, as many young adults have given up these dreams because of the burden of student debt.

“We’re all buying houses later, we’re getting married later,” she said. “Devin and I are a perfect example of that because we bought a house at 29 years old.”

Crawford’s journey to happiness came with many obstacles. She comes from a low-income background and is a Pell Grant recipient. Her family relied on food stamps for a time and dealt with an eviction.

“Coming from a low-income background, I never felt like I’d ever achieve financial security,” she said.

She looks at her own life and looks at the lives of those younger than her, navigating the same struggles she did and needing student loans to afford college.

“I do worry about the future of millennials, my generation, and those younger than me with student loan debt,” she said.

Crawford nearly dropped out of graduate school because of the student loans she would have to accrue. She’s still paying back $36,000 in loans.

Because of this, she resonates with the students she teaches at the University of Wisconsin-Madison. Crawford is the Director of Financial Wellness and Financial Aid Advising at the School of Medicine and Public Health.

“Everything that we talk about, from student loan repayment to saving for retirement to insurance, is all very overwhelming and there’s not a lot of good information out there,” she said.

Crawford teaches a course on financial literacy to fourth-year medical students. More than half of them nationwide will graduate with six figures in student loan debt. Nick Spoerk is one of them.

“It’s very anxiety inducing to have to think about these things,” he said. “What am I going to do? How am I going to repay this and it’s easy to push it off?”

Spoerk is graduating with almost $200,000 in student loans. He’s completing his residency in Brooklyn, which he knows will add to his debt. He said Emma’s guidance was a relief.

“It’s very anxiety-relieving to go through the planning of these are the decisions I have to make and this is when I have to make them,” he said.

A blueprint for financial freedom and an instructor who understands what her students are going through.

“I understand what it’s like coming from an income-limited background and graduating with student loans,” Crawford said. “Not knowing where to go, or how to tackle these important financial situations, we all juggle every day.”

A rewarding task Crawford said she’s glad to take on. She plans to become a Certified Financial Planner in order to better meet the needs of the students she works with.