BUFFALO COUNTY, Wis. — Wisconsin is known for having some of the best places to hunt, but how some of that recreational land is bought up and taxed has raised revenue concerns.

Buffalo County officials are worried the state's Managed Forest Law (MFL) program has gone against what it was intended to do.

Jason Wood, a forester, spends a lot of time in the outdoors helping people come up with plans for the state's MFL program, which offers tax breaks to encourage sustainable forestry.

“MFL land is real similar to a portfolio, so I mean you've got, you know certain investments that are going to mature at different times and you want to take care of that in one way or another, and it's no different for your property,” Wood explained.

However, in Buffalo County, where MFL land has increased by an average of 2,000 acres per year over the past three years, Wood is concerned people aren't enrolling in the program for the right reasons, especially when he sees high fences around land plots.

“It's passable by wildlife, but do you really think that that should be allowed on tax break land,” Wood asked when showing one of the fences. “So, I mean it's basically a fence made to corral deer. That's all it's for.”

In Buffalo County, hunting-rich land drives up property values due to supply and demand.

Oftentimes, non-local buyers will purchase recreational land and enroll it in the state's MFL program to save money on taxes.

“With the land prices selling the way they are, you know then you have to have a [reevaluation], and then that increases the value of the property which is going to be high taxes for them and the woodland gets hit the hardest,” Buffalo Co. Treasurer Tina Anibas said.

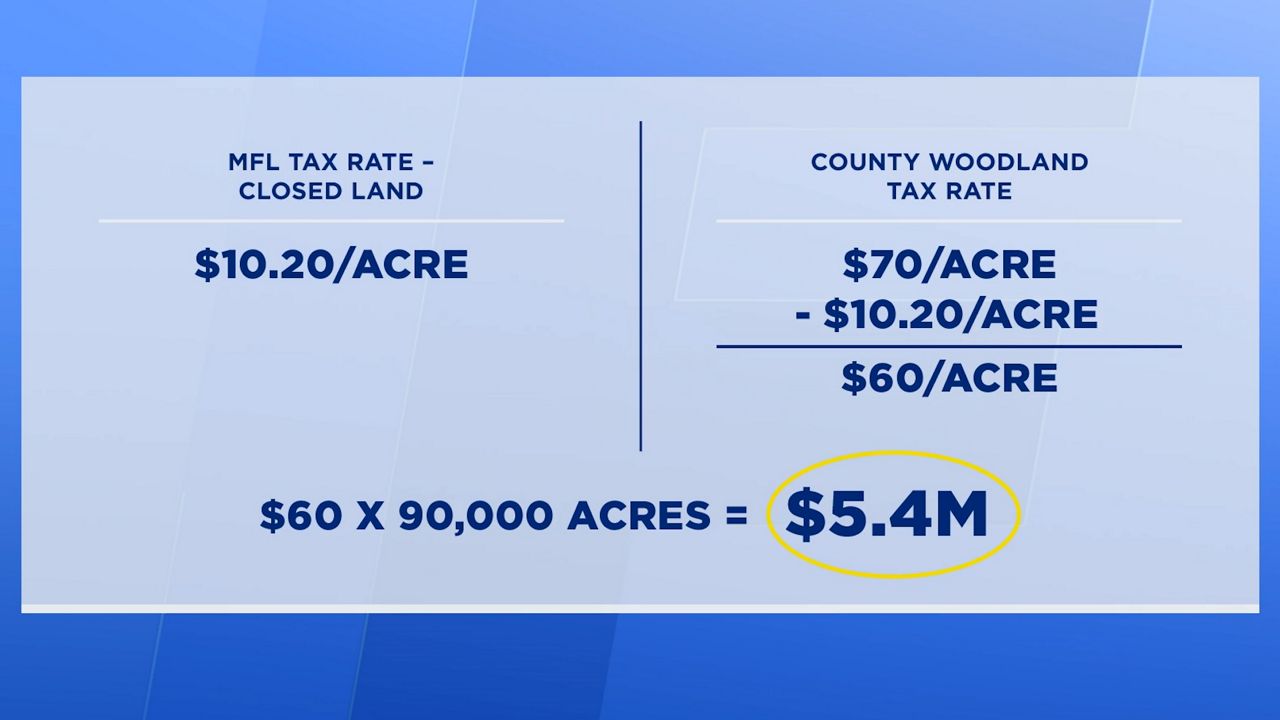

Currently, MFL land that is closed to the public is taxed at a rate of $10.20 per acre compared to the average woodland tax rate of $70 per acre in Buffalo Co.

That means Buffalo Co. loses roughly $60 in revenue for every acre of closed MFL land, which amounts to a $5.4 million loss in tax revenue.

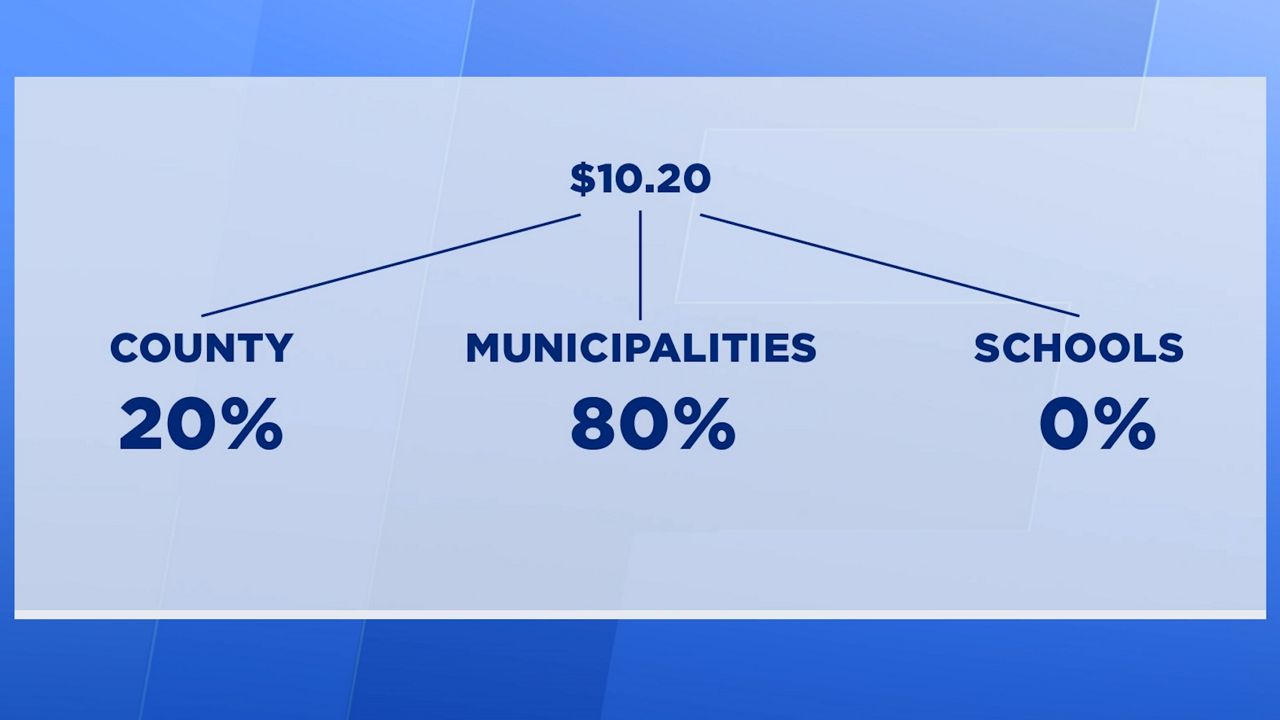

Revenue generated at the MFL tax rate is split between counties and townships, so schools do not receive any of those funds.

Based on how the state aid formula is structured, school districts like Alma often lose funding because high property values make it seem as though the district needs less funding and can rely more on local taxes.

“We're losing so much in state aid,” Alma School District Superintendent Rob Stewart explained. “Every year, we're losing anywhere from 3% to 5% in state aid because of the fact that property values are rising, and so when you're losing that state aid and you're not getting that relief from those taxes, what it ends up doing is it doesn't allow us to expand some programs, but what it also does is it, unfortunately, hurts local taxpayers because you know then they have to pick up the missing amount.”

Nearly 90,000 acres of Buffalo Co. is MFL land, which amounts to roughly 20%.

“If you're a non-resident, or whatever, then this is what you qualify for as a rate for MFL, and if you're a homestead property this will be your rate,” Max Weiss, a Buffalo Co. Supervisor suggested. “I think there has to be options explored, I guess. Like anything else, I don't think there is a fix-all, one solution.”

With a property tax levy that still needs to be met, county board supervisors want to find a way to help locals who aren't in the program but are often left to make up the difference with high ownership costs.

Some of those landowners are forced to sell their property or enroll their land in the MFL program themselves because they can't afford the taxes.

“If you have the money to invest into your recreation, you shouldn't deprive others,” State Sen. Jeff Smith, D-Brunswick, said.

Smith, who represents the area, has been trying to find a solution too.

“A simple answer would be to not allow an out-of-state landowner to sign into the MFL program,” Smith said. “That would maybe shutdown that abuse we're seeing.”

However, for Wood, it's a matter of just doing things for the right reason.

“More DNR personnel being involved and making sure people follow the program,” Wood said.