CINCINNATI – Hamilton County has expanded one of its COVID-19 relief programs to help homeowners who've fallen behind on their property taxes.

What You Need To Know

- Hamilton County is offering up to six months relief on past-due property taxes

- There are several eligibility requirements related to income and whether or not its

- Hamilton County is using federal COVID-19 relief funds to offset the cost

- This is one of several COVID-realted relief programs from the county

County officials outlined details of the newly renamed and retooled Mortgage, Property Tax and Utility Relief Program Monday morning during a press conference at Todd B. Portune Center for County Government in downtown Cincinnati.

Now, eligible homeowners can get funds to enable them to catch up on up to six months of delinquent tax payments dating back to March 1, 2020. It doesn’t matter if those taxes are tied to a mortgage.

Payments will be made directly to the Hamilton County Treasurer’s Office.

As part of the program, in-need homeowners are able to apply for assistance on past-due mortgage and utility payments as well.

Hamilton County Treasure Jill Schiller said she’s “thrilled” to be able to provide people a little extra financial relief and peace of mind during the holiday season.

“The county has worked to provide relief for those struggling financially throughout the pandemic. The American Rescue Plan gives us an opportunity to aid those taxpayers who need it the most,” she said. “We are excited to expand this relief program to assist in the payment of property taxes for those individuals who qualify.”

There are a series of qualifications required in order to be eligible for the assistance program. To qualify, the property in question has to be in Hamilton County and it must be the owner’s primary residence. Second homes, rental properties and short-term rentals are not eligible.

Like with other COVID relief programs, an applicant must also prove they experienced a negative financial impact between now and when the pandemic started around March 2020.

From a financial standpoint, the program has a "really broad eligibility span," according to Kevin Holt, with Hamilton County Jobs and Family Services – the agency that administers the program.

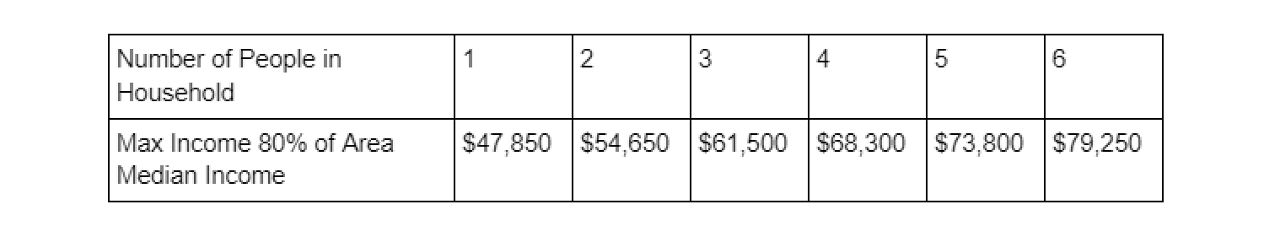

To qualify for the tax relief, the homeowner's income cannot exceed 80% of the area median income, which is a technical definition for the median income level earned by a given household in a particular location.

Holt said “that's a lot of numbers and acronyms, but the important thing to remember is this is wildly inclusive.” He gave the example of a mother with two children – in that situation, she would qualify if she earns $61,500, or less a year.

A homeowner who lives alone would qualify if they earn $47,850. For a family of six, the household income can’t be greater than $78,250.

Income includes unemployment wages, per the county.

Schiller said her office planned to start sending mail Monday to every delinquent tax payer in the county, alerting them to the fact their taxes are past due and this program exists. Tax due bills will go out Jan. 5, 2022.

"We hope to get a few people in the door before then," Schiller said.

Joining the treasurer Monday were all three Hamilton County commissioners – Commission President Stephanie Summerow Dumas and Commissioners Alicia Reece and Denise Driehaus.

The Commissioners launched the relief program in late October with a focus on mortgage and utility payments for homeowners. The program provides assistance for up to six months in past-due mortgage payments and a year in overdue utility payments, both dating back to March 1, 2020.

The intent was to start the property tax element of the program earlier this year, but there were legal questions about whether it qualified as a use for federal relief funds.

Lawyers from the Hamilton County Prosecutor's Office, which operates as the county’s attorneys, provided a legal opinion on the matter. That office determined property tax relief would be allowable use because the funds will benefit COVID affected residents and its “within the spirit of providing relief to homeowners,” Schiller said. She added that they "cleared a couple hurdles quicker than they feared."

"We were (already) taking care of property tax payments that were in escrow through that program," Schiller said. “This is for folks who either don't have a mortgage, or who pay their property taxes separately from the mortgage."

Hamilton County earmarked $5 million of its allocation of American Rescue Plan dollars to fund the overall program. Those in attendance said that figure should be enough to cover expected needs for mortgage, tax and utility needs of homeowners.

About 100 homeowners have applied for mortgage and/or utility relief so far.

Jobs and Family Services aims to get the approval process down to about 10 days, but right now, they’re still trying to get it down to the 30-day mark. The current application-to-payment timeline is about 45 days, Holt said.

There’s a bit of a backlog for some of the other relief programs, but they “don’t want to drop the ball” on the property tax relief, according to Holt. The agency said there are some nuances about the program and other mechanisms in place that should speed up the turnaround time.

Holt reminded those interested in applying for tax relief, mortgage and utility assistance or any other COVID help, it's best not to wait until the last minute to submit an application.

“This is not an emergency program. This is a program in long-term investment. So you want to come to us, give us a little bit of time and then we can bring big dollars to the table,” he said.

The Mortgage, Property Tax and Utility Relief Program is one of several county-led COVID-19 relief programs. It operates similarly to the county rent program, which has served nearly 7,700 households since July 2020. That amounts to more than $22 million in rent and utility assistance.

Summerow Dumas said the need for assistance is great – she described it as persistent and ongoing.

“The need is great. Now whether or not we’ve reached everyone we want to reach, that's another question,” she added. The county is using social media to get the message to the community and let people know that resources are available. Hamilton County has a “513 Relief” van that travels to communities across the county sharing information and helping people fill out applications.

“We do not want to leave any money on the table. We've given out a lot of money, but there's much more money to give out and many more people to reach,” she said.

Those interested in applying can email HCJFS.Mortgage@jfs.ohio.gov, or visit https://erap.hcjfs.org. On the website, select “Mortgage and Utility Relief” under the tenant link and write “Property Tax” in the text box.

Information about this program and other Hamilton County programs are available through the 513 Relief website.