AKRON, Ohio – Any relief from the pandemic — economical or emotional — has been short lived for the performance venue industry in nearly all states, including Ohio. This is despite being awarded $16.2 billion in December to keep the shuttered businesses afloat.

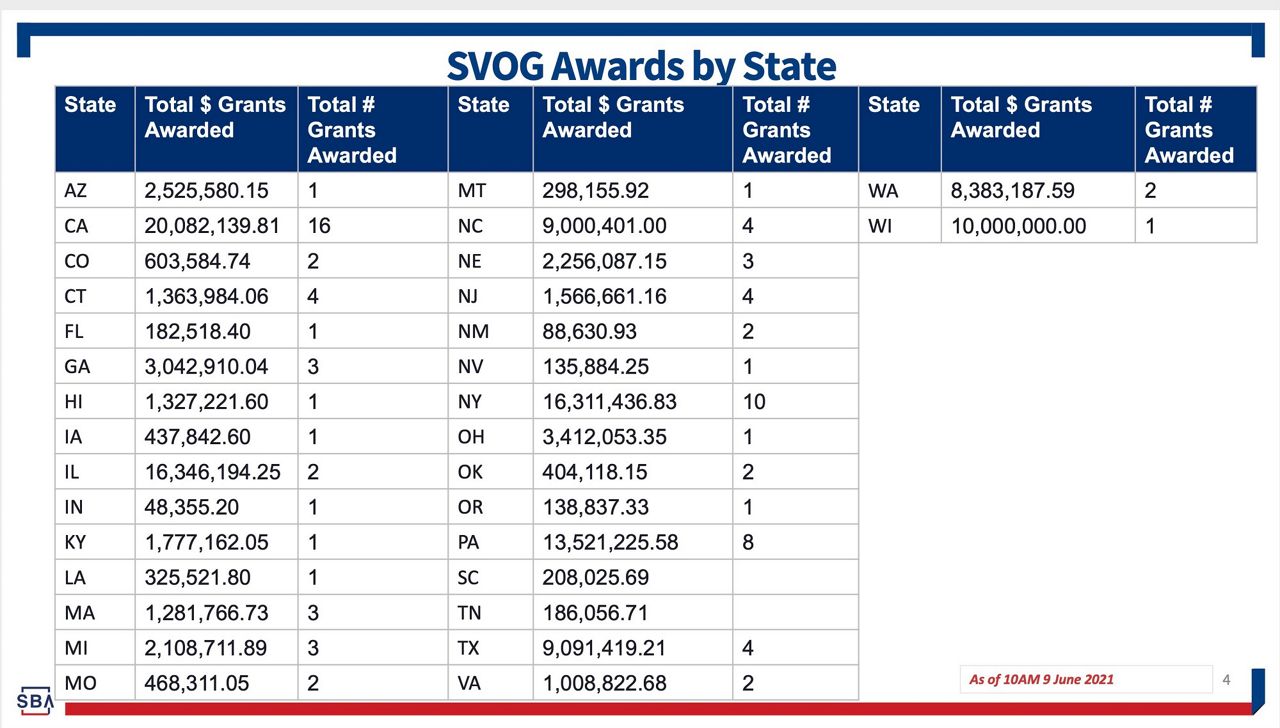

The U.S. Small Business Association’s Office Of Disaster Recovery in charge of the Shuttered Venue Operators Grant distribution has approved one grant award in Ohio, and fewer than four awards in most other states, according to the SBA’s SVOG most recent public report issued June 9.

Under the federal SVOG program, eligible venues and businesses could apply for up to 45% of their gross earned revenue, up to $10 million, with grants awarded based on three tiers of need, with the hardest hit venues funded in Tier 1. Venues include performance-related businesses that could not survive on pandemic assistance designed for food-service establishments and traditional bars, as well as museums and movie theaters.

June 9 was also the last day of a 14-day priority period in which the SBA was to have processed all applications for Tier 1 venues — that is venues suffering greater than 90% revenue loss, according to the National Independent Venue Association.

With nearly 5,000 Tier 1 applications submitted across the country, SBA said it had processed only 50 applications. That’s despite Congress allocating money to hire 500 additional reviewers to assist the Office of Disaster Recovery in processing the SVOG, the NIVA reported.

The NIVA was founded last March in response to the pandemic and championed the COVID-19 relief bill to represent the performance-related businesses. The organization represents more than 3,000 members across the nation.

“If each [reviewer] analyzed just one application a day, 17,000 applications would have been processed by now,” the NIVA recently wrote in a memo to Congress. “But yet, the SBA has processed fewer than 100 applications in the six weeks since the application portal opened.”

In a statement, the SBA said it has dedicated hundreds of reviewers “working around the clock” and had distributed about $128 million in grants.

The SBA appears to blame the delay on the complexity of the applications, stating “the SBA has inherited an extremely complex program that requires manual and painstaking processing of applications due to the particular requirements outlined in the statute.”

But the SVOG distribution has been plagued since its inception. The application portal first launched April 8, crashed April 8, on its first attempt, reopening April, 28, the NIVA said.

The SBA also told the venues it expected to have award notices out and funds dispersed to Tier 1 applicants by the end of May.

In many cases, applications are mistakenly being blocked because of a name match on a federal “Do Not Pay list,” or an error on the Tax Form 4506-T, said Nina Ozlu Tunceli, executive director of the Americans for the Arts Action Fund.

Tunceli sent a memo to venue operators announcing the SBA’s Office of Disaster Assistance will now be assisted by workers in the office of Capital Assistance, which ran the $800 billion Paycheck Protection Program. SBA also is integrating experts from the Restaurant Revitalization Fund “who are committed to cutting through the red tape to achieve fast results,” she wrote. Tunceli said she would be attending new, daily SVOG briefings and sharing the information with venues.

In the statement, the SBA said it will now keep venues apprised of their supplication status weekly, and will continue to post weekly progress reports. It also stressed the SVOG is not being moved out of Disaster Recovery, but admitted the office will be shored up by the additional experts from the capital assistance.

However, the NIVA issued a statement to venues stating, “We just met the NEW SVOG LEADERSHIP team at the SBA. The old team has been replaced with the team that handled the RRF, and they seemed confident and competent. They made statements that reflected a REAL understanding of how much our businesses urgently need this money. Before today, the SBA was handling this program with a mentality dominated by a ‘fraud avoidance’ mentality. Now, they've shifted gears to a "GET THE MONEY OUT AS SOON ASAP" mentality.”

Ohio venues, museums, movie theaters and talent representatives stand to receive nearly $500 million in aid from the SVOG, or about 3% of the $16.25 billion approved by Congress, said Sean Watterson, Ohio’s NIVA precinct captain and co-chair of the SVOG implementation task force.

Watterson also owns the Happy Dog Bar in Cleveland, which has been closed for more than a year.

“The Office of Disaster Assistance never wanted this program. They resented being blamed for fraud in other programs, like PPP and EIDL, and reacted spitefully, solving for the risk of fraud by not making any awards at all (90 grants in response to the 14,000 applications made),” Watterson wrote on his Facebook page. “We’ve been lied to, blamed, ignored, patronized — everything but funded. The SBA hired 500 reviewers who took 6 weeks to make 90 grant awards. Any way you do the math, it is unforgivable.”

Early this month, NIVA members across the country began bombarding lawmakers with letters pleading for help and sharing their personal stories, illustrating how important the venues are to their local economies.

Jill Bacon Madden, who owns the Jilly’s Music Room in Akron, told lawmakers she had depleted her savings, sold personal property and is now selling clothing online to cover utility bills, insurance and taxes to keep her club, which has been voted best bar in the city.

After the SVOG was passed in December, she announced a July reopening, which will be canceled without the grant money, she said.

A Tier 1 applicant, Bacon Madden said her application status remains “submitted” in the SBA’s system, even though she sent in her application — with more than 500 pages of required documentation — within two hours of the portal opening.

“The non-action, floundering, and epic failure of the SBA is unconscionable and it is ruining lives and viable businesses,” she wrote. “I will have to close permanently. Sell my building, declare bankruptcy, and try to rebuild my life — and my 25 employees (who ALL stand ready to return) will have to rebuild theirs, and artists will have one less place to perform — seriously diminishing their ability to pay their bills.”

In Cleveland’s Gordon Square Arts District, the shuttered Capitol Theatre, considered an anchor of the community, had to postpone it 100th birthday celebration to the middle of July. Without the SVOG funds, the theater has resorted to a $50,000 fundraiser to cover the basics of reopening safely, the NIVA told Congress in the memo.

“If the Capitol goes, the millions of dollars invested in bringing it back to life go to waste,” the group said. “The businesses surrounding the Capitol depend on the 60,000 people a year the theater attracts to the neighborhood to spend money … in the district.”

In its statement, the SBA said it understands the desperation of the venues, writing, "The current pace of awards is not reflective of the high standards that we strive to meet.”

When the administrative changes were announced earlier this week, the NIVA told its members their messages to Congress had worked, writing, “Today was the first time the SBA consistently called SVOG ‘emergency relief.'" Previously, it was always referred to as "grants."

But to venue owners, like Watterson, the new attitude could be too little, too late.

“The SBA has singlehandedly done more damage to independent music venues in the last six months than COVID did in the prior nine,” he wrote on Facebook. “Life savings exhausted, homes mortgaged, personal guarantees made on lines of credit — all done after the bill passed, with the expectation of implementation. This will take years to repair, and the sad thing is, none of the people responsible for this epic fail will ever be held to account.”