WASHINGTON, D.C. — Lawmakers on Capitol Hill have agreed on a $78 billion tax package that includes a provision to help thousands of victims of last year’s train derailment in East Palestine, Ohio.

What You Need To Know

- Bipartisan tax deal includes provision to exempt East Palestine train derailment relief payments from federal taxes

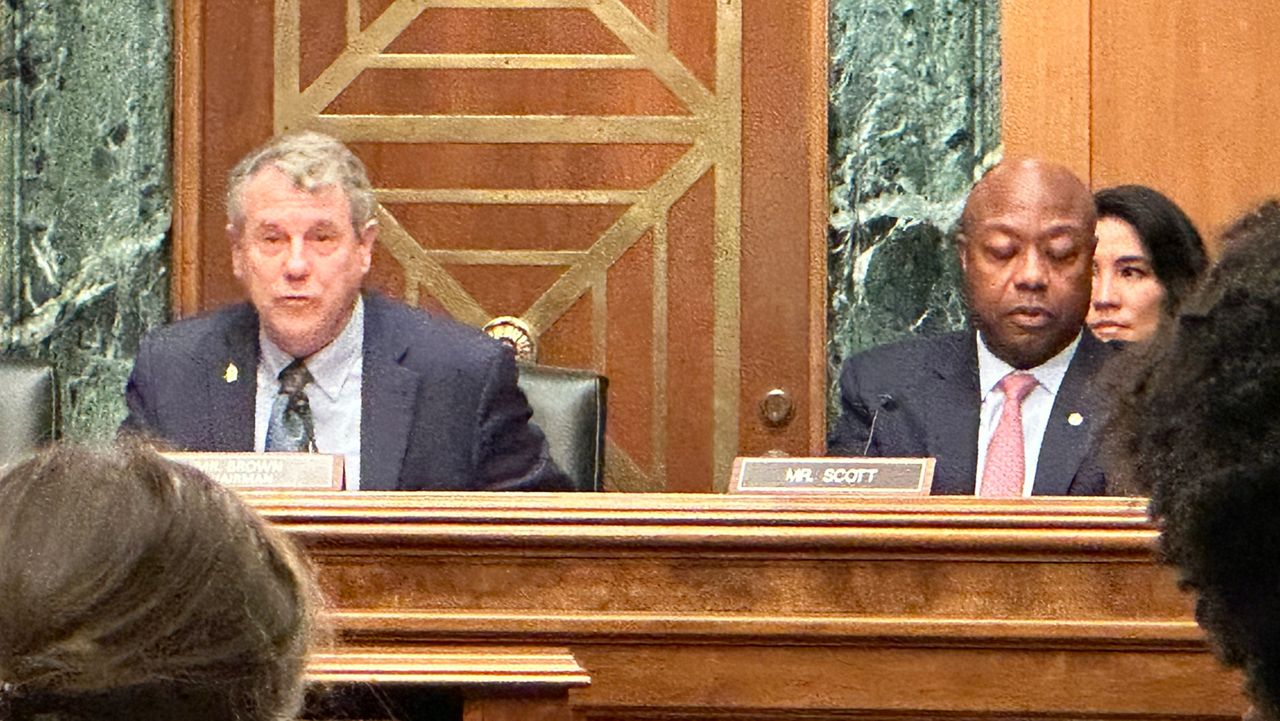

- Sen. Sherrod Brown led the push to include the provision in the legislation

- Norfolk Southern said it has paid $21 million to East Palestine residents

Since the train derailment in Feb. 2023 that spilled dangerous chemicals into the community, residents of East Palestine have received payments to cover related losses, like property damage, personal injuries and business losses.

Train operator Norfolk Southern said it paid $21 million to 4,536 families affected by the disaster, coming out to about $4,666 per family.

Lawmakers and officials have pushed Norfolk Southern to pay more for environmental and economic damages caused by the derailment. The Ohio Attorney General’s Office negotiated with the company to pay homeowners selling their houses and moving away the difference of their lost property value.

Taxes on those payments, though, could run into the hundreds or even thousands for each family.

“It's caused a lot of families, some their health, others their finances. So Norfolk Southern under some pressure is reimbursing a lot of these families for the damage they cause,” said Sen. Sherrod Brown, D-Ohio. “Under federal law, the way the tax law is written, they might get hit with a tax bill for these dollars that Norfolk Southern provided them to help get their lives back. So we're just saying no taxes on these. They shouldn't pay a penny of taxes on these quote unquote benefits they got from Norfolk Southern.”

Brown was behind the push to include the East Palestine relief payment exemption in the Bipartisan Tax Deal.

The State of Ohio and Village of East Palestine have already exempted the payments from state and local taxes.

East Palestine Mayor Trent Conaway said in a statement in Sept. 2023:

“The derailment has been a big enough burden on everyone. No one should have to pay taxes on this money after what they’ve already gone through..."

East Palestine residents said the tax exemption was at least one small relief amid all the challenges they’ve gone through since the derailment.

“It would make a huge difference because nobody in the community asked for this train derailment or ensuring chemical calamity to happen. I think it’s really the right thing to do,” said Misti Allison, a resident and advocate.

Norfolk Southern has announced that payments for residents who have not yet returned to East Palestine will end on Feb. 9, six days after the first anniversary of the incident.

The company wrote in a statement:

"Norfolk Southern is committed to making it right in East Palestine. To date, we have contributed $103 million to the community, including $21 million directly to residents. We are pleased to see Congress addressing this issue that will help provide those residents with much needed tax relief.”

The Republican chair of the House Ways and Means Committee and the Democratic chair of the Senate Finance Committee negotiated the deal, a rare show of bipartisanship in a divided Congress. Passage of the bill is not assured, however, at a time Congress is struggling just to pass a new budget.

Correction: The previous version of this story incorrectly stated what Norfolk Southern paid an average per family. This article has been updated to show the company paid an average of $4,666 per family. (Jan. 24, 2024)