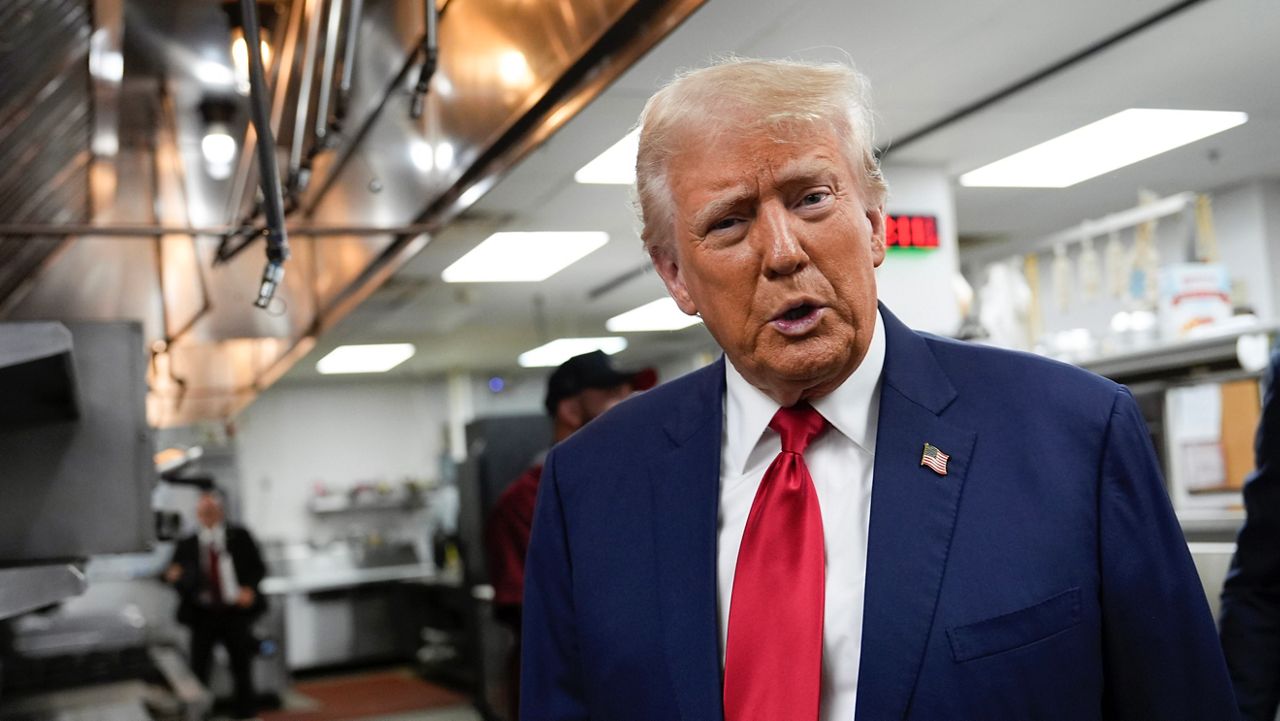

On the final leg of his campaign tour counterprogramming this week’s Democratic National Convention, former President Donald Trump stopped at a Mexican restaurant in Las Vegas to talk about the no-tax-on-tips policy he first introduced in June.

“If you’re a restaurant worker, a bartender, a hospitality worker, a caddy, a barber, a driver of any kind or anyone else, you rely on a lot of tip income,” he said, adding that if reelected in November, “We are going to let you keep 100% of your tip income and not be harassed.”

Trump said about 5.5 million workers in the U.S. depend on tip income for their livelihoods, including 700,000 single mothers nationwide who rely on tips to support their children.

Las Vegas is home to one of the country’s largest concentrations of people who work in the service industry.

The federal minimum wage for tipped workers is $2.13 per hour — a rate that has not changed in decades.

Tips are treated as taxable income by the Internal Revenue Service. About half of waitresses and waiters in the U.S. make less than $32,000 in wages and tips annually, according to the Bureau of Labor Statistics.

Trump said “In our case, we really mean it” when promising no taxes on tips. “We’re going to do this very fast, too, by the way.”

“Kamala Harris is now pretending to endorse my policy,” he said of the current Vice President and newly minted Democratic presidential nominee. “She’s just a copycat. She’s a flip flopper. She went from communism to capitalism in about two weeks.”

However, the Harris policy differs from Trump's. When asked by reporters, Trump said that his "no tax on tips" plan would go "full bore" -- that it would cover tips from both income taxes and payroll taxes. The Harris campaign has said it would ensure that tips are not subject to income tax, but would be subject to payroll tax. Payroll taxes fund programs like Social Security and Medicare.

The former president chastised Harris for casting the tie-breaking vote to hire 87,000 new IRS agents “to go after your tip income,” he said. “They’re going after it in a lot of ways.”

In 2021, the Biden administration approved hiring 87,000 new Internal Revenue Service employees by 2031, only a small percentage of which are agents. The majority of hires are expected to fill vacancies as more than half of the agency’s employees are eligible for retirement by 2026.

The IRS’s current workforce is about 79,000 employees, 8,000 of whom are agents who audit tax filings and 2,000 of whom investigate possible tax crimes.

In a short speech that reiterated many of the points he had made earlier in the week at other counterprogramming campaign stops, Trump blamed Harris for inflation and high energy prices and promised to cut taxes, reduce regulations and make America affordable again if reelected.