DETROIT — Ford Motor Co. swung to a net loss in the fourth quarter because of a large accounting charge on pension plans and the effects of a six-week strike at multiple factories, including in Louisville, by the United Auto Workers union.

The Dearborn, Michigan, automaker posted a $523 million net loss from October through December versus a $1.26 billion profit for the same period a year ago.

Excluding one time items, the company made 29 cents per share, beating Wall Street estimates of 12 cents, according to analysts polled by FactSet.

Revenue for the period was $46 billion, up 4% from a year ago, beating estimates of $43 billion.

Ford reported a $1.7 billion noncash accounting loss during the quarter on remeasurement of pension and other post-retirement employee benefits.

The company predicted it would have pretax earnings this year in a range of $10 billion to $12 billion.

Ford said earlier that the strike cost the company $1.7 billion in lost profits and cut sales to dealers by 100,000 vehicles. Most of the loss happened in the fourth quarter.

Ford said the strike caused it to lose production of high-profit trucks and SUVs. UAW workers shut down the company’s largest and most profitable factory in Louisville, Kentucky, which makes big SUVs and heavy-duty pickup trucks.

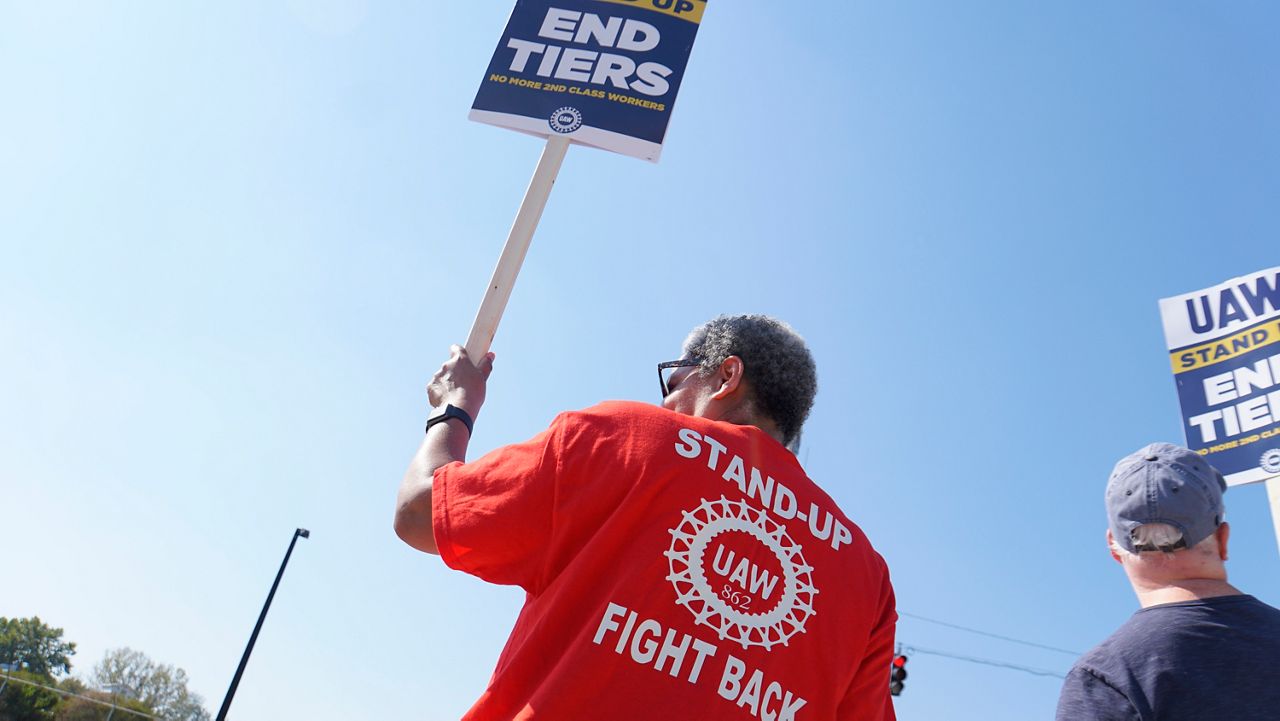

The UAW strike began Sept. 15, targeting assembly plants and other facilities at Ford, General Motors and Jeep maker Stellantis. The strike ended at Ford on Oct. 25.

Ford and the other companies agreed to new contracts with the UAW that raise top assembly plant worker pay by approximately 33% by the time the deals expire in April 2028. The contracts also ended some lower tiers of wages, gave raises to temporary workers, and shortened the time it takes for full-time workers to get to the top of the pay scale.

At the end of the contract, top-scale assembly workers will make about $42 per hour, plus they’ll get annual profit-sharing checks.

Ford said the contract will add about $900 to the cost of each vehicle, and it will try to offset that with productivity gains and expense reductions.