LEXINGTON, Ky. – Research by the Better Business Bureau shows employment scams are affecting those already suffering financially during the ongoing COVID-19 pandemic.

In the wake of COVID-19 business shutdowns, the Better Business Bureau study shows employment scams continue to be the No.1 riskiest scam to job seekers, but scams overall have increased as con artists attempt to take advantage of unemployed workers and struggling businesses.

Central and Eastern Kentucky Better Business Bureau Director of Communications Heather Clary said the study’s focus is warning unemployed people about phony jobs being offered, especially online.

“This was a survey done by the BBB Institute for Marketplace Trust among individuals across North America who had reported to BBB Scam Tracker seeing or falling for job scams as COVID19 ramped up,” Clary said. “People are unemployed and so many people have been left jobless. We just want people to know threats are still out there.”

The BBB Employment Scams Report examines findings from an April 2020 survey of 10,670 U.S. and Canadian consumers reporting employment scams to BBB Scam Tracker. The study was launched after COVID-19 forced business shutdowns across North America, leaving hundreds of thousands of people jobless.

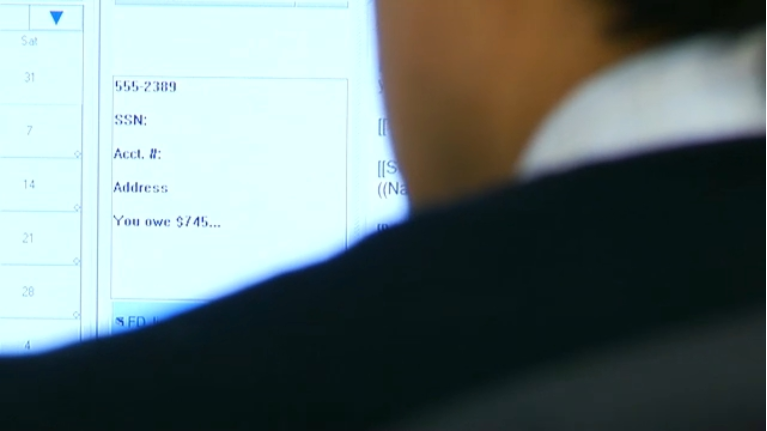

Employment scams typically occur when job applicants are led to believe they are applying or have just been hired for a promising new job, but they have instead fallen for a scam. This can mean giving personal information that can be used for identity theft or sending money for “training” or “equipment.” In another variation, the victim may be “overpaid” with a fake check and asked to wire back the difference.

The more common employment “scam job” offer is related to the reshipment of packages, which Clary said often involves stolen products. Titles used include “warehouse redistribution coordinator” or similar positions. In many cases, these scammers impersonated well-known retailers such as Amazon and Walmart to appear legitimate, posting jobs on major online employment platforms, such as Indeed, with few prerequisites or requirements.

“We have been hearing about that for years but it has increased significantly since the pandemic began,” Clary said. “In this scenario, scammers sell stolen merchandise, often bought with stolen credit cards or acquired through other scams.”

Clary said another prevalent scam involves asking people to wrap their car with a decal for money.

“The trick is, they send you a check, then ask you to send the money somewhere else,” Clary said. “But, the checks are fake. The same thing is the problem with the work-at-home scams that claim to pay you for posting ads online for Amazon. These aren’t real jobs.”

The BBB Employment Scams Report shows that nearly three-quarters of those who lost money to employment scams are already in financial crisis, and don’t have enough money to cover monthly bills. More than half of the people targeted by employment scams (53 percent) reported being unemployed at the time of the encounter.

BBB launched a new research project after the pandemic caused countless business closures and subsequent massive job losses. The study aims to better understand how employment scams are being perpetrated, who is being targeted, the overall impact of these scams and how to help people avoid losing money to them.

“This research was timely as we found that more than half of scam targets were seeking work-from-home opportunities,” said Melisa Lanning Trumpower, executive director of the BBB Institute for Marketplace Trust. “As more people search for flexible employment opportunities following the coronavirus outbreak, they need to know that scammers are out there in force and targeting those most in need.”

The report also highlights those who are most at risk for employment scams. Students and individuals ages 25-34 were more susceptible and likely to be victimized. Those ages 45-54 and 65-and-older reported higher median dollar losses. Military spouses and veterans were more likely to fall victim than non-military consumers and reported losing significantly more money to employment scams.

Survey results reinforced that consumer education is a critical component of fighting back against these scammers. Those who avoided losing money were much more likely to report previous knowledge of employment scams and tactics (20 percent versus 7 percent).

Customers have also reported online purchase scams. One Lexington resident reports losing $112 this past June in an online scam while another Lexington resident, who didn't want us to share her name, fell victim to an employment scam.

“During my employment search, I happened upon an Indeed.com employment posting for an office manager/admin manager for a new branch office opening Lexington,” she said. “I was contacted by email that I was being considered as one of the top candidates and asked about a time for a phone interview. Details about health insurance were even provided.”

The resident said she was told this new office location was not yet open, but as the office manager, the company might need her assistance with setup and possibly buying supplies.

“I was told they would send a cashier’s check to cover these ‘business expenses,’ which was yet another red flag for me,” she said. “I received the check in an envelope via overnight UPS delivery, and upon review of the check, I contacted the issuing bank. The check was made out to me, with no memo for office supplies, and for the sum of $4,900.”

She said the issuing bank, the Bank of Texas, was notified and I was informed the account number was real but had been flagged as a fraud alert. The check’s routing number was not correct.

“I never provided them anything other than my application, address and phone number,” she said. “I did not cash the check, noted ‘void’ across the front then called the FDIC fraud office and the BBB.”

In 80 percent of employment scams reported to BBB Scam Tracker, contact was initiated by the scammer. The more frequent methods scammers used to engage with targets were email and text. For every victim who lost money, at least one other worked without pay or lost personal information.

“One can never be too sure about whether something is a scam,” Clary said. “We have scams reported for just about everything in Lexington, from personal assistant jobs to rental scams, and rental scams are big here. People see a three-bedroom, two-bath house with all utilities included for $1,000 a month, so they wire the deposit, etc., and the person receiving the money doesn’t even own the property.”

If you need to report a scam, go to the BBB Scam Tracker. to report a scam