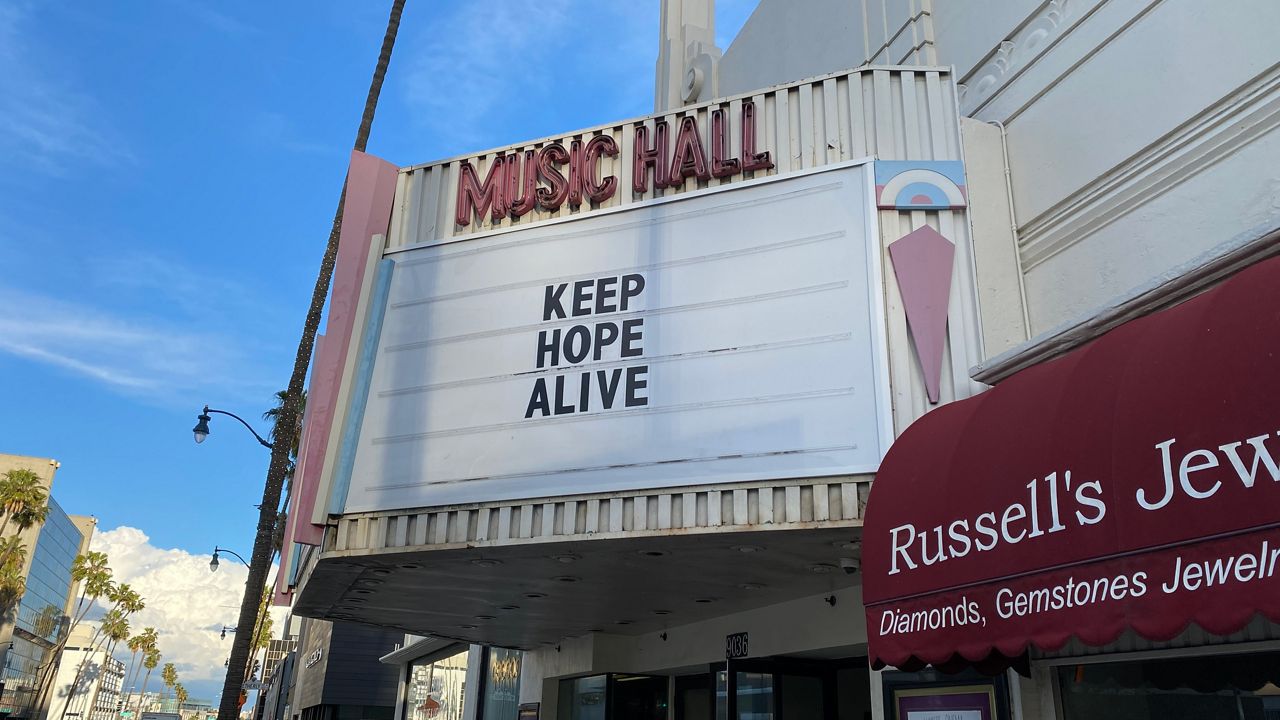

BEVERLY HILLS, Calif. — Every day, Luis Orellana spends a few hours at the Music Hall 3, the only multi-screen movie theater in Beverly Hills.

Usually starting in the early afternoon, he'll unlock the door, collect the mail, knock out some repair work, answer phone calls, then turn on the marquee and wait.

There’s not much he can do.

Until Los Angeles County’s pandemic restrictions loosen, Lumiere Cinemas — the company he and two other former staff members under the Music Hall’s previous owners — won’t be able to screen a single film at the Music Hall.

So he hangs out, waiting for people to walk past, and even into, the theater lobby. He talks movies, tells people about the streaming options Lumiere is offering, and sells some popcorn.

“I like turning on the lights, leaving the marquee on,” Orellana said. “It reminds people that it’s not abandoned — I’m here.”

But he might not be for much longer. Lumiere’s landlord has lost patience; according to Variety, another company will be taking over the Music Hall later this year, and Lumiere is being forced out.

It’s hard to make money as a movie theater if you can’t hold screenings. To make matters worse, Lumiere has been stunningly unsuccessful in obtaining loans and grants.

“We’re looking at a situaiton where we’ve been applying for loans from the (Small Business Association) for nearly a year now and we’re on our third round of it,” said Peter Ambrosio, a co-founder of Lumiere alongside Orellana and Lauren Brown. Each time, they’ve been rejected.

One advocate working with Lumiere said its situation is one of the worst cases he’s seen during this pandemic.

“If this was a normal disaster — a flood, hurricane — it wouldn’t have been a problem. A human being, a case manager, would have looked over at their documents and made an assessment,” said Trevor Shickman, a business advisor with the Pacific Coast Regional Small Business Development Center.

Small Business Development Centers, like the Pacific Coast Regional SBDC, provide free and low-cost consulting to new and existing small businesses in partnership with the federal Small Business Administration.

According to Pat Nye, Regional Director for the Los Angeles Small Business Development Network, L.A.’s SBDCs have been able to secure about $500 million in funding for client businesses since the pandemic began, helping about 15,000 businesses.

But one group of small businesses has had consistent trouble, he said: folks who got started in the months immediately before the pandemic.

“It’s been tough for anyone who’s been brand new. The guidelines they set for the Paycheck Protection Program and the Economic Injury Disaster Loans, you had to be an existing business,” Nye said. “I think they didn’t want funds to be diverted to someone looking to start, but to support someone who had been in business, to keep them going.”

Lumiere Cinemas counts itself among those unlucky few.

The Music Hall 3 was set to go dark in Nov. 2019. After 40 years operating the three-screen complex, Laemmle Theatres — a family-owned arthouse movie theater chain — announced it was leaving amid a larger reorganization of venues.

Then Ambrosio, Brown and Orellana stepped up and secured the rights to the space, promising to continue the Laemmle tradition. Christening their operation as Lumiere Cinemas, they began screenings just after the Thanksgiving 2019 holiday.

Four months later, the screens went dark anyway. Movie theaters across Los Angeles County have been shuttered for about a year in accordance with the pandemic response.

In that time, millons of businesses across California and the United States have been able to secure loans and grants to help them survive through the pandemic.

As of March 7, 2.4 million PPP loans, worth a total of $164 billion, have been approved by the SBA in 2021 alone. More than $200 billion in Economic Injury Disaster Loans, designed to help businesses and nonprofits pay expenses, such as rent, utilities, and health care, have been approved since last April.

In the $1.9 trillion economic "American Rescue Plan Act" stimulus bill signed Thursday by Pres. Joe Biden, another $7.25 billion has been authorized for the PPP loan program, and $15 million more has been added to the EIDL program. According to Rob Seltzer, an accountant specializing in working with small businesses, the act is targeted toward those businesses that have foundered during the pandemic, like bars and restaurants.

"It's been a struglgle for them — without the PPP loans, they would ahve all gone under, becasue they still ahve to pay their rent and have insurance, et cetera," Seltzer said. "So these grants will allow them to rebound and be able to reopen."

The package also boosts the Shuttered Venue Operators Grant program with $1.25 billion in funding for operators in the performing arts, including movie theater operators. It's expanded eligibility, Seltzer said, "to include more nonprofits and digital media companies. Certainly that would be helpful, because we are the entertainment capital of the world."

But so far, Lumiere Cinemas hasn’t seen any of that money. It’s a huge source of frustration, especially to Ambrosio — his main source of income, a filmmaking and production business, received an EIDL loan “immediately” at the beginning of the pandemic.

“It’s really absurd, given that we’re a majority-minority business, a brand new business, the American Dream in terms of employees who decided to take a risk, and it’s as though the government is like ‘we want this pandemic to ruin you,’” Ambrosio said.

It feels, he said, like they’ve been stuck in a bureaucratic sinkhole. Correspondance with the SBA, he said, has been confusing, if not outright contradictory. (Requests for comment from the SBA have not been returned by publication time.)

Even messages to the office of U.S. Rep. Ted Lieu, who represents much of the Westside, Beverly Hills, and the South Bay, had fallen flat for a while. A representative for Lieu would not confirm if his office had contact with Lumiere, citing office policy, but said that they’ve helped “hundreds of constituents” with pandemic-related business assistance. However, Ambrosio said a Lieu representative recently reached out to see if Lumiere has made any headway with the SBA.

To complicate matters, in February, Variety reported that the Music Hall had been leased by Blue Fox entertainment for a planned October reopening. That news came amid increasingly frigid negotiations with Lumiere’s landlords at the Music Hall.

There’s some good news, though: L.A. County’s likely move from the most restrictive tier of COVID business regulations means that Lumiere might open as soon as Monday. And if that happens, they’re going to be ready.

“We’re making a mad dash we’ve started prep, but we still have a lot to do,” Ambrosio said. Early guidance from the county, he said, suggests that they won’t be able to sell concessions to movie patrons. “But we’re going to see if we can open immediately — we’re flexible, light on our feet, so we might just barrel ahead and see if we can make it work.”

After that, though, things are up in the air. Lumiere hasn’t gotten a formal complaint from its landlords, though Ambrosio expects they’ll leave as soon as the eviction moratorium ends.

But until they’re out, Orellana plans to keep showing up at the Music Hall. He even announces, most every day on social media, the hours that he’ll be in the house, selling popcorn and other concessions. Recently, he flipped over the posters that had been on the walls outside the ticket booth and wrote lengthy messages in marker, letting customers know that they're still there.

"For everything we've been throughleading to this annoucnement and our own decision to stay, being able to open is huge right now," Orellana said.