WASHINGTON, D.C. — More Americans are ordering packages online from foreign retailers than ever before —and those packages arrive quickly thanks to a trade rule that fast-tracks them into the country. But one lawmaker says the rule is hurting American manufacturers and wants to end it.

What You Need To Know

- The “de minimis” trade rule allows packages wit contents valued at less than $800 to enter the country without tariffs and under a simplified process

- Some lawmakers say it hurts American manufacturers by giving foreign companies a cost advantage and want to change the rule

- Some members of the business community say the de minimis rule lowers costs and makes trade more efficient

The “de minimis” trade rule allows packages with contents valued at less than $800 to enter the country without tariffs and under a simplified process. It’s meant to conserve limited government resources and reduce costs for consumers, as well as allow citizens to ship low-values souvenirs home from abroad.

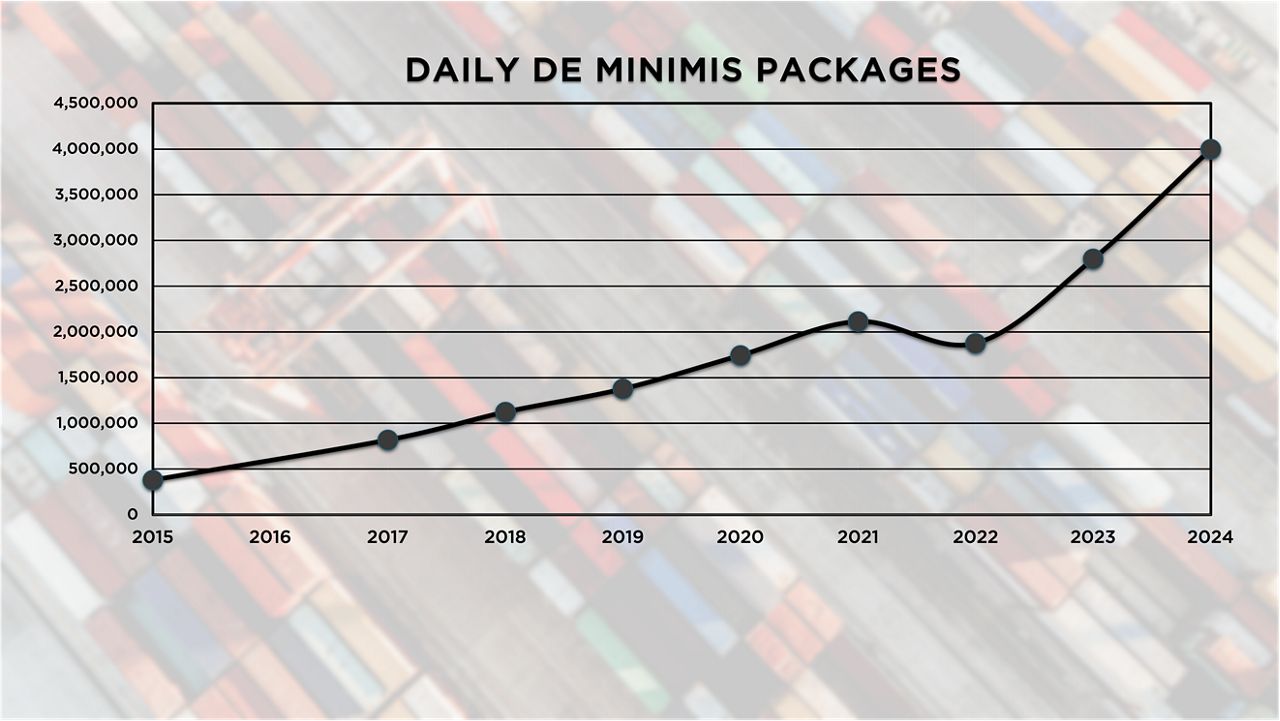

De minimis packages are pouring into the U.S. in record numbers. Nearly 4 million currently arrive each day, up 950% from 2015, according to data from U.S. Customs and Border Protection (CBP).

Chinese companies Shein and Temu alone account for a third of those packages, according to a report published by the House Select Subcommittee on the Chinese Communist Party.

Some lawmakers said the de minimis rule gives those companies and others a cost advantage over American manufacturers and allows them to violate labor laws.

Sen. Sherrod Brown, D-Ohio, wrote in a public letter to President Joe Biden in Feburary,

“This generous gift comes with no rule of origin requirements, reciprocal market access, or labor or environmental standards. Simply put, the [Chinese Communist Party] and others utilizing de minimis can get rich while getting away with a host of trade infractions that undermine U.S. manufacturing, harm American workers and expedite the flow of fentanyl and other harmful goods into our communities.”

Brown, along with Senators Ron Wyden (D-OR), Cynthia Lummis (R-WY), Susan Collins (R-ME) and Bob Casey (D-PA), are co-sponsoring legislation to close what they call the de minimis “loophole.”

The FIGHTING for America Act of 2024 would make apparel and some other goods ineligible to be imported through the de minimis rule, meaning that they would be subject to tariffs and additional inspections, and would add a $2 fee per shipment of goods that do qualify for de minimis.

“If we do this right, if a president closes this loophole, it will mean more revenue for the government, a fairer playing field for American companies,” Brown said at a visit to an Ohio textile manufacturer on Aug. 2 that his campaign shared online.

Not all of the U.S. business community supports tightening de minimis rules. Doing so would roughly double the cost of certain imported products, said John Pickel, senior director of international supply chain policy at the National Foreign Trade Council, a trade association. Pickel added that with an average de minimis package value of $54, any additional revenue generated by more tariffs would be erased by the added cost of conducting more inspections.

“If they're collecting $1 to $2 and spending a lot of time and a lot of energy and a lot of resources to be able to do that, they're not executing those other responsibilities, whether that's looking for narcotics, where it's actually coming into the country, or identifying counterfeits or forced labor or whatever else,” he said.

Pickel also pointed to a study by researchers at Yale and UCLA that found reining in de minimis rules would result in up to a $14 billion economic loss that would disproportionately hurt low-income and minority consumers.

"Businesses are constantly shifting their supply chains, and and quick, low-cost shipments to consumers have really helped bridge the gap," he said.

Pickel instead supports broader reform to how all imports are inspected and taxed.

Lawmakers and law enforcement, such as CPB head Troy Miller, have warned the de minimis rule allows illicit fentanyl to be more easily smuggled into the country. However, CBD data shows 99% of fentanyl is seized at the U.S. southern border.