OSHKOSH, Wis. — Summertime fun outside of Lakeside Marina includes boats going up and down the Fox River, many powered by Mercury Marine motors.

The Fond du Lac manufacturer recently announced about 300 layoffs, citing a drop in demand for their product.

Lakeside Marina Sales Manager Corey Bodenbach said Mercury is the only motor he sells with his new boats.

“They build an exceptional product. They’ve never given us a reason to look elsewhere. We're very privileged to carry such an iconic brand," said Bodenbach.

He feels for people recently laid off and believes that the surge of boat sales during the pandemic, when people were searching for outside activities, is part of the issue.

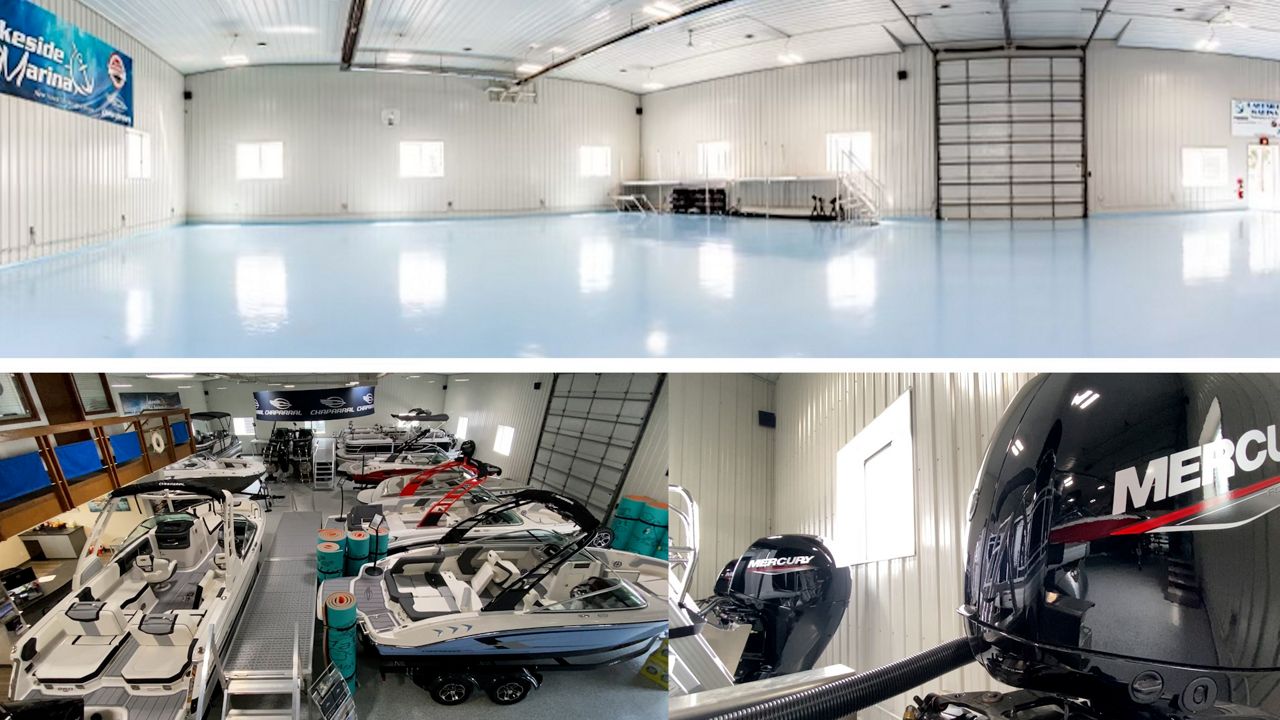

“It went up about 11% which brought a lot of new customers to our industry and overwhelmed the dealer network," explained Bodenbach. "I know for a few years we had an empty showroom because we sold everything we had.”

With so many recently purchased boats, consumer demand dropped as financing terms became more difficult.

“You know, a $50,000 boat we were selling in 2020, 2021 that somebody could finance for $400 a month is now a $65,000 boat that they're financing for $700 plus a month," said Bodenbach.

Dealerships filled up with boats.

“When they're sitting heavy with that inventory, they're not ordering that new product, which is what Mercury needs," said Bodenbach.

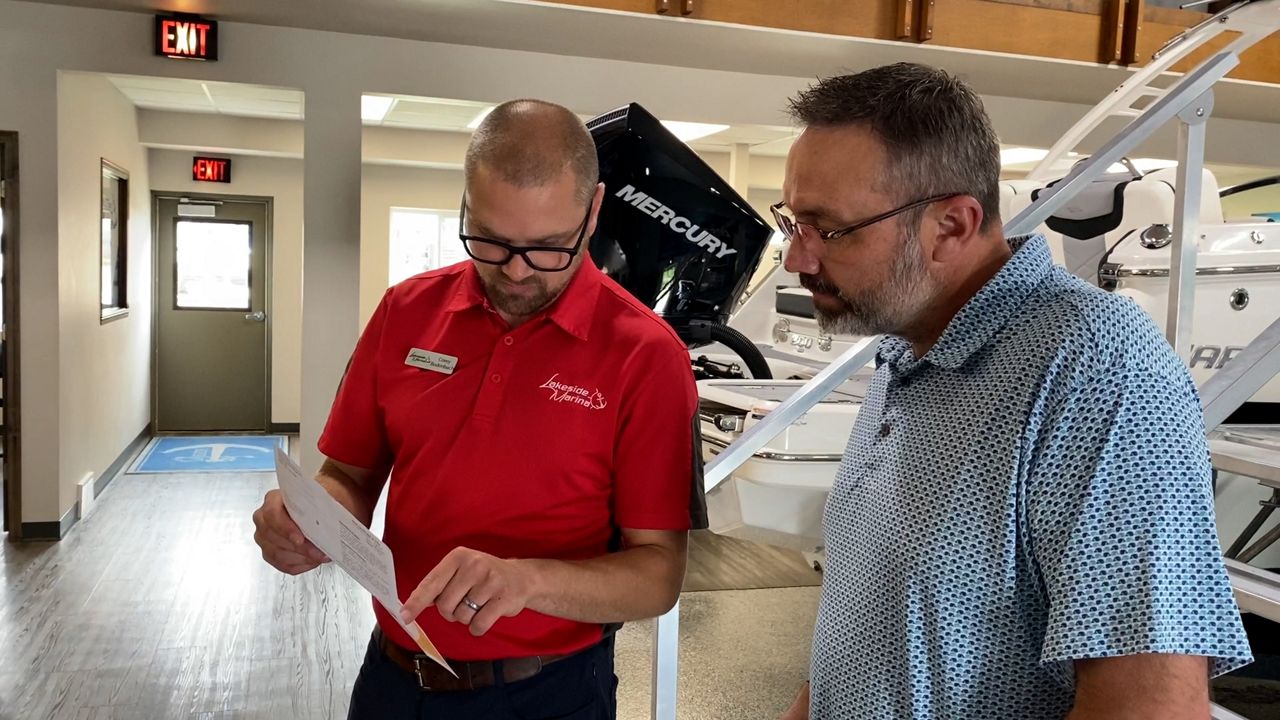

The used market can also cut into new boat sales. Mike Brockhaus of Hartford came in to collect a check after Lakeside Marina helped sell his four-year-old boat.

He cited a change in family interests as his reason to sell.

“Family dynamics, family changes, and we wanted to go smaller, so we’re more getting into kayaking and doing low-key kind of stuff," said Brockhaus.

Besides Mercury and other manufacturers, some dealerships could be in trouble, too.

“A lot of dealers are still sitting with an excess inventory of what I would say they're comfortable with," explained Bodenbach. "A lot of that is aged inventory of leftover products.”

A smaller but growing component eating into new boat sales is boat clubs which spread the cost of purchase, maintenance, storage and more over several people with an annual fee.

Lakeside keeps a couple of boats docked on the Fox River for their members.

“You just have an annual membership that's typically quite a bit more cost-effective than owning. You basically get to use the boat at your leisure with other members also kind of using those available times," said Bodenbach.

Some people in the market for a boat will pay cash for the latest and greatest but many other buyers are open to getting a deal on a used boat.

“What we have seen is people start to shift their mindset to looking for something maybe a few years newer, pre-owned, where they still feel like they’re getting a really nice clean boat," said Bodenbach.

Many pandemic-era boats now sit idle as things returned to normal and other activities opened up to owners. Those may also hit the market and find buyers as new boats price some consumers out of the market.

“Oh my gosh, yeah I can’t imagine. I’ve seen the prices on some of them and it’s nuts," said Brockhaus.

The hits keep coming as Bodenbach thinks a rainy start to the boating season also put the damper on prospective buyers, which could potentially mean more rough waters ahead for the industry.