WASHINGTON — On Capitol Hill, a $78 billion tax relief bill negotiated by top Republicans and Democrats could be headed to the House floor next week. The bipartisan deal, rare in the current Congress, would restore three popular Trump-era business tax breaks. But a centerpiece of the compromise would expand the child tax credit, which addresses child poverty. A temporary expansion of the tax credit three years ago helped many families get through the pandemic.

“The impetus for the changes in the child [tax] credit has come from a lot of the research that we saw after the 2021 changes — the tremendous drop in child poverty, the stability that it brought to families,” said Jean Ross, a senior fellow at the Center for American Progress.

The expansion of the child tax credit in 2021 resulted in most families receiving checks up to $3,600, per qualifying child. The credit went back down to $2,000 a year later. Under the new legislation, the maximum credit would increase and be adjusted each year for inflation.

The left-leaning Center for American Progress said if the child tax credit is expanded, 224,000 Wisconsin residents under 17, whose families are not eligible for the full credit now, would benefit in the first year.

While some would have liked to see Congress go back to the 2021 changes, Ross said the more limited measure will still have a positive impact on families and children.

“It'd be a huge change for a low-income family. Take a single parent of two earning $22,000 a year as a child care worker, for example. They would get an additional $675. That's enough to buy snow boots, warm clothing for a child,” Ross said. “It is enough to help a family afford better nutrition.”

According to the state Office of Children’s Mental Health, Wisconsin families mostly spent their child tax credit in 2021 on food.

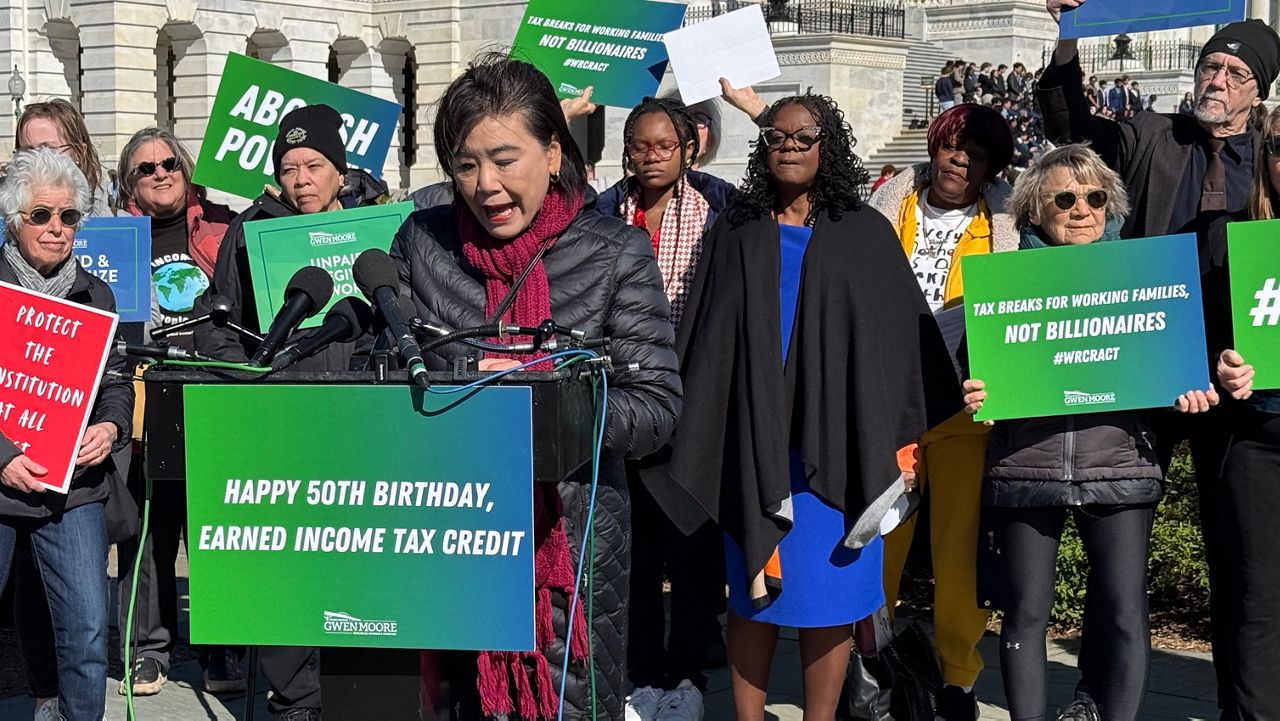

Congresswoman Gwen Moore, D-Milwaukee, voted against the tax deal in the House Ways and Means committee, saying the poorest children would be left behind. Parents have to earn at least $2,500 to be eligible, and if they don’t earn enough money on top of that, they can’t claim the full credit.

“If you're a stay-at-home mom, and you've got a husband who's making $200,000 a year, you get the credit,” Rep. Moore said. “And I guess the big problem is redefining what this is. This is not about rewarding parents, rewarding kids, based on how much money their parents make. It's supposed to be about recognizing the high cost of rearing kids, whatever your income is, and providing a child supplement.”

Rep. Jason Smith, R-Missouri, the Ways and Means Committee chairman, said in a statement that Americans have been struggling with inflation and the "child tax credit is a simple, straight-forward solution to put more of their hard-earned money back in their pockets."

The bill’s passage by Congress is not assured. However, the legislation received a boost when House Republican leaders agreed to allow a vote by the full chamber as early as next week. President Joe Biden said he supports the measure.