BEIRUT (AP) — Lebanese depositors, including a retired police officer, stormed at least four banks in the cash-strapped country Tuesday after banks ended a weeklong closure and partially reopened.

As the tiny Mediterranean nation's crippling economic crisis continues to worsen, a growing number of Lebanese depositors have opted to break into banks and forcefully withdraw their trapped savings. Lebanon's cash-strapped banks have imposed informal limits on cash withdrawals. The break-ins reflect growing public anger toward the banks and the authorities who have struggled to reform the country's corrupt and battered economy.

Three-quarters of the population has plunged into poverty in an economic crisis that the World Bank describes as one of the worst in over a century. Meanwhile, the Lebanese pound has lost 90% of its value against the dollar, making it difficult for millions across the country to cope with skyrocketing prices.

Ali al-Sahli, a retired officer who served in Lebanon’s Internal Security Forces, raided a BLC Bank branch in the eastern town of Chtaura, demanding $24,000 in trapped savings to transfer to his son, who owes rent and tuition fees in Ukraine.

“Count the money, before one of you dies,” al-Sahli said in a video he recorded with one hand while waving a gun in the other.

According to Depositors’ Outcry, a protest group, al-Sahli said he had offered to sell his kidney to fund his son’s expenses after the bank for months blocked him from transferring money. With his son owing months of rent and tuition, the retired officer reached out to the protest group for help.

In the video he filmed on his cellphone, al-Sahli waved a handgun, threatening to shoot, if bank employees didn’t oblige. Employees struggled to calm him down, as protesters from the depositors group and bystanders watched from outside.

Al-Sahli was unable to retrieve any of his money, and security forces arrested him.

In the southern city of Tyre, Ali Hodroj broke into a Byblos Bank branch, demanding about $40,000 of his trapped savings to pay outstanding loans. He held a handgun and fired a warning shot, as security forces encircled the area. Hodroj retrieved about $9,000 in Lebanese pounds, following negotiations, with the head of a depositors advocacy group mediating.

Hassan Moghnieh, head of the Association of Depositors in Lebanon, told The Associated Press that Hodroj's family retrieved the money before he turned himself in to police outside the branch.

In Hazmieh near the Lebanese capital, former Lebanese Ambassador to Turkey Georges Siam entered an Intercontinental Bank of Lebanon demanding some of his locked savings. The branch staff shuttered its doors while Siam continued to negotiate with management.

And in the northern city of Tripoli, workers from the Qadisha Electricity Co. broke into a local First National Bank branch protesting banks deducting fees from their delayed salary payments. The Lebanese Army arrived at the site in Tripoli and patrolled the area.

Some depositors' protest groups, including the Depositors' Outcry, have supported the break-ins and vowed to continue doing so.

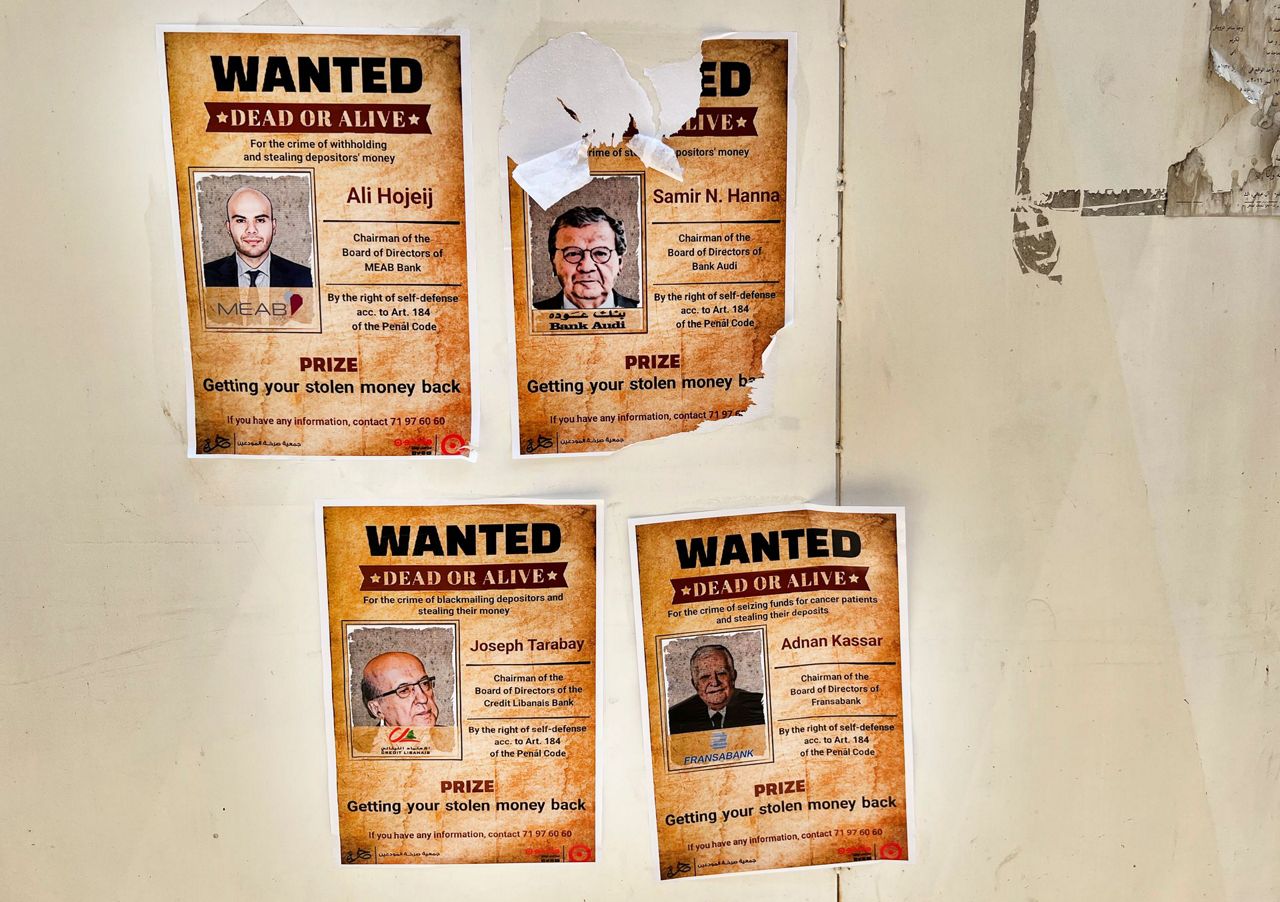

“We're sending a message to the banks that their security measures won't stop the depositors, because these depositors are all struggling,” Depositors' Outcry media coordinator Moussa Agassi told the AP. “We're trying to tell the bank owners to try to find a solution, and beefing up security measures isn't going to keep them safe.”

The general public has commended the angry depositors, some even hailing them as heroes, most notably Sally Hafez, who stormed a Beirut bank branch with a fake pistol and gasoline canister to take some $13,000 to fund her 23- year-old sister's cancer treatment. Siam was among those who praised her. “We need more of that,” he said in a tweet last month. “The lady is a hero. God bless her.”

The banks, however, have condemned the heists, and urged the Lebanese government to provide security personnel.

The Association of Banks in Lebanon in a statement Tuesday said the government is primarily responsible for the financial crisis, and that the banks have been unjust targets. The banks in the statement urged the government to swiftly enact reforms and reach an agreement with The International Monetary Fund for a bailout program.

The ABL in late September shuttered for one week after at least seven depositors stormed into branches and forcefully took their trapped savings that month, citing security concerns. The banks last week partially reopened a handful of branches, only welcoming commercial clients with appointments into their premises.

Lebanon meanwhile has been struggling to restructure its financial sector and economy to reach an agreement with The International Monetary Fund for a bailout. The IMF has criticized Lebanese officials for their slow progress.

Copyright 2022 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.