The Biden administration on Thursday announced it is canceling $4.5 billion in student loans for more than 60,000 public service workers, such as nurses, teachers, police officers and firefighters.

The fresh wave of relief brings the total number of such workers who have seen student debt forgiven to more than one million during President Joe Biden’s time in office.

“This milestone isn't just a number, it's life changing debt relief for over a million people who now have more breathing room to buy homes, start small businesses, save for retirement and more,” White House deputy chief of staff Natalie Quillian said on a call with reporters previewing the announcement.

The Biden administration has been able to provide the relief through enacting reforms to the Public Service Loan Forgiveness program – which is intended to offer student loan forgiveness to people who spend at least a decade in a public service role – to ensure it is better reaching eligible people.

“They were promised student loan forgiveness after 10 years of public service and 10 years of payments, but for too long, the program failed to live up to that commitment,” Quillian said of those in the PSLF program. “The program was riddled with administrative errors. Many people were denied because they were told that they weren't in the right repayment plan or weren't given credit by their loan servicers for past payments in the past.”

Before Biden took office, the White House said, only 7,000 people had received loan forgiveness through the program. Thursday’s announcement of one million people now impacted marks a 14,000% increase in people affected during Biden’s presidency, Education Secretary Miguel Cardona told reporters on a call.

“When I became secretary, thankfully, President Biden and Vice President [Kamala] Harris made fixing Public Service Loan Forgiveness a priority from day one,” Cardona said. “We at the Department of Education created a process to make sure borrowers got credit for past payments; we conducted extensive outreach; we enacted new rules, streamlining the process and centralizing management.”

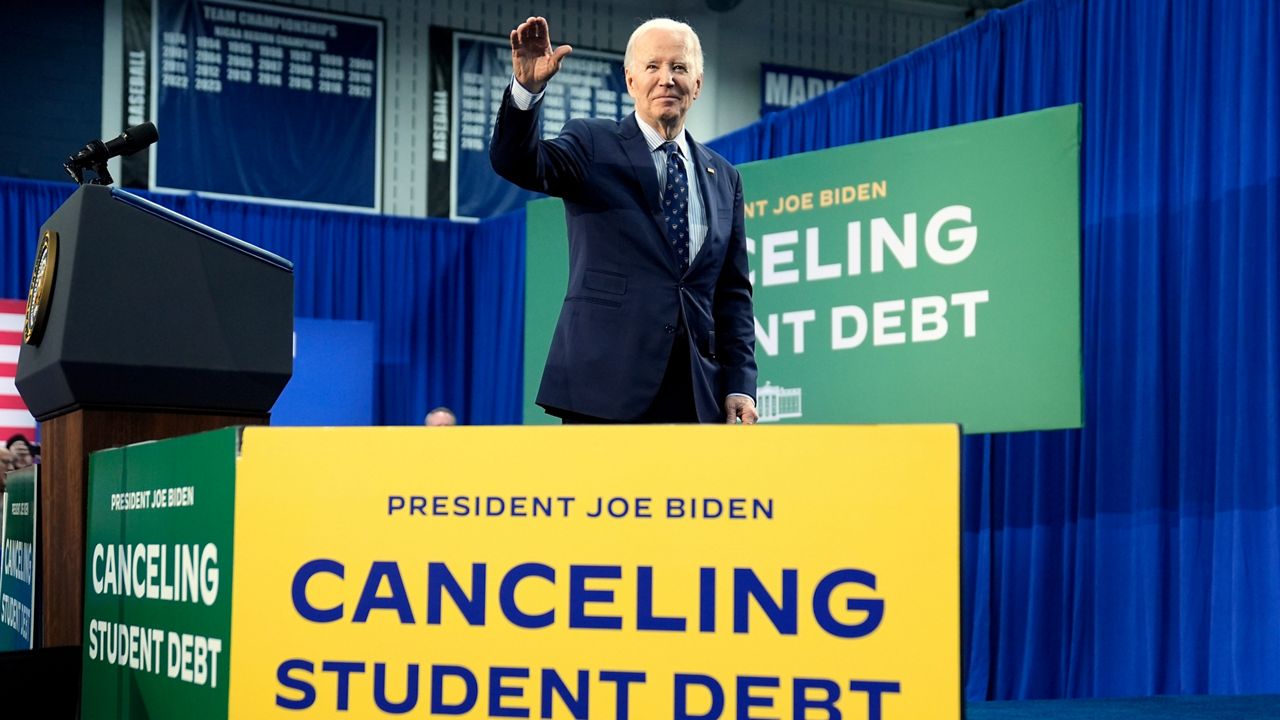

Thursday’s announcement marks a significant development for Biden, as he prepares to leave office in January, on an issue that started as a pledge on the campaign trail ahead of the 2020 election and became a priority during his presidency. In total, more than five million student borrowers have received at least some debt relief under Biden’s presidency, the White House said.

“From day one of my Administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity,” Biden said in a statement announcing Thursday’s new round of relief. “I will never stop working to make higher education affordable – no matter how many times Republican elected officials try to stop us.”

But it also comes as the future of his broader relief plan and his agenda on the topic more widely is highly unclear.

Earlier this month, a federal judge in Missouri halted Biden from moving forward for the time being on his yet-to-be finalized plan to cancel debt for more than 30 million borrowers. It came just a day after a separate federal judge in Georgia decided it could proceed. The plan was expected to be finalized this fall, and the administration said in July it was beginning to email people who may be eligible for relief earlier this summer.

That plan is already whittled down from Biden’s original and sweeping proposal to forgive up to $20,000 in student debt for all Americans making under a certain income, which was struck down by the Supreme Court in June 2023.

The new repayment plan, called the SAVE Plan, that Biden also announced in the wake of the Supreme Court’s decision, which sought to lower monthly payments for borrowers, is also held up in legal battles. The so-called “on-ramp” period in which borrowers could not receive harsh financial penalties, such as being reported to credit bureaus or debt collection agencies, if they missed a payment between Oct. 2023 and Sept. 2024, when they were easing back into payments after a three-year pandemic pause has also just ended.