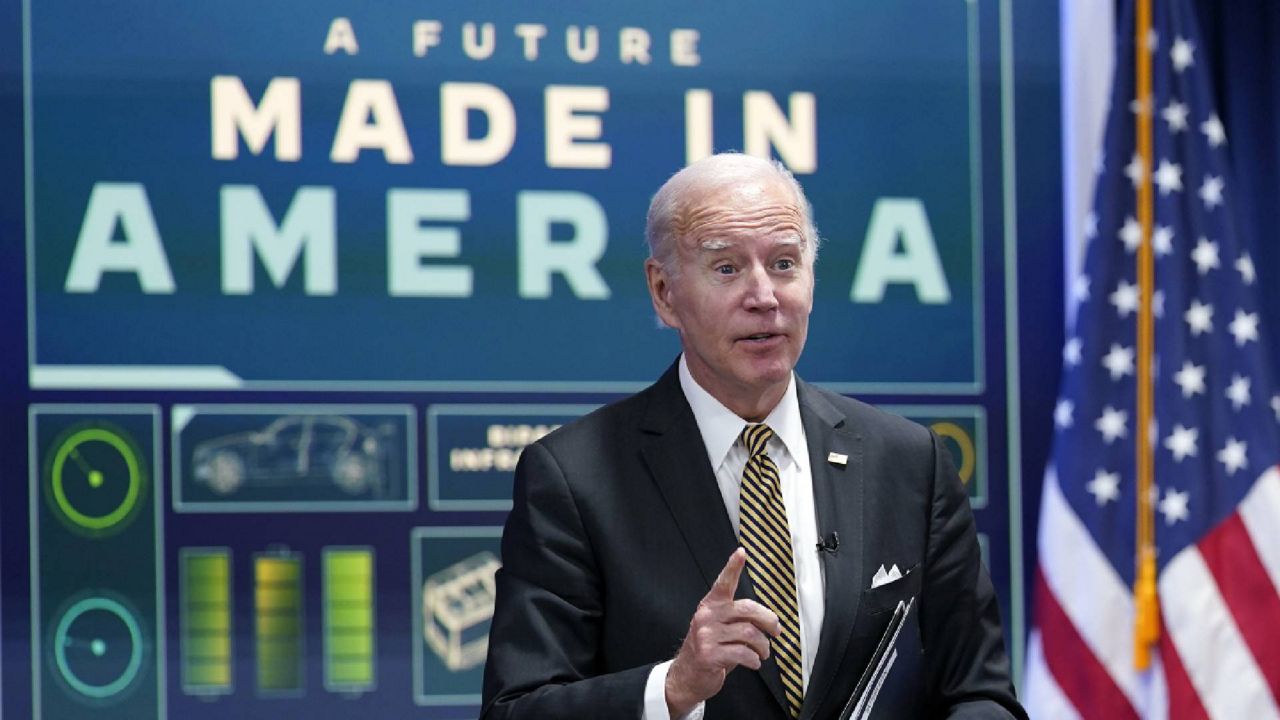

President Joe Biden on Wednesday announced $2.8 billion in grants to boost the electric vehicle battery supply chain — funding projects to produce things like battery-grade lithium, graphite nickel and binding material in an effort to break the U.S. away from its dependence on foreign suppliers.

Demand for electric vehicles in the U.S. has ticked up in recent years, doubling their market share in 2021 and continuing to grow in 2022, according to the International Energy Agency. Kelley Blue Book announced Wednesday that electric vehicle sales hit a record in the third quarter of 2022, “outpacing the rest of the industry.”

And under Biden, the federal government has bet big on EVs — from money in the bipartisan infrastructure law and semiconductor bills to a historic investment in clean energy in the Democrats-only climate, tax and health care law. Early in his presidency, Biden set a goal to make electric vehicles half of all new vehicles sold by 2030.

"The future of vehicles is electric. But the battery is a key part of that electric vehicle," Biden said during a Wednesday event on EV infrastructure. "And right now ... 75% of that battery manufacturing is done in China."

Biden said the demand for critical battery materials "is set to skyrocket by four to six hundred percent."

"The demand for minerals like lithium and graphite is expected to increase by as much as 4,000%," he said. "We see an opportunity, a real opportunity, to shift to a net zero-sum carbon world."

Still, electric vehicles remain expensive and out of reach for many. Kelley Blue Book reported the average price of a new EV last month was $65,291, aligning more with luxury vehicle pricing.

The $2.8 billion for materials projects announced Wednesday comes from the infrastructure law passed last fall. It will fund projects in Alabama, Georgia, Kentucky, Louisiana, Missouri, Nevada, New York, North Carolina, North Dakota, Ohio, Tennessee, and Washington.

The projects include efforts to make enough lithium to supply two million EVs each year, the White House said, plus enough graphite to supply 1.2 million.

The money will also help create an electrode binder facility, a key element of assembling batteries. The project could fulfill 45% of U.S. binder demand in 2030.

Energy Secretary Jennifer Granholm lauded the companies awarded grants for investing in the new effort as well, therefore "believing" in the future of EVs.

"This is the time to bet big on a clean energy boom that's made in America," she said.

Biden on Wednesday noted how the United States is currently dependent on foreign suppliers for battery materials, with China controlling most of the output.

According to the Department of Energy, the projects funded this year include:

- Developing a new process to extract and refine lithium from a sedimentary deposit in Nevada through the American Battery Technology Company, which has rarely been done widescale; most battery-grade lithium comes from outside the country

- Expanding and upgrading Cirba Solutions’ existing lithium-ion recycling facility in Lancaster, Ohio to produce more lithium

- Ascend Elements will construct a cathode active materials (CAM) plant at a greenfield site in Hopkinsville, Kentucky

- Albemarle will construct a new, commercial-scale U.S.-based lithium materials processing plant at Kings Mountain, North Carolina

- Anovion will expand its Sanborn, New York manufacturing into Alabama with a new graphite manufacturing facility

Albemarle CEO Kent Masters spoke to the president from North Carolina about his company's plans to open a new lithium mine and construct a "world-scale" processing facility with long-term jobs.

"It is that full supply chain. It's not the only facility like this we'll need in the U.S. to be self-sufficient, but it's a good start," he said.

The Biden administration is also launching an effort they call the American Battery Materials Initiative, led by the White House and DOE, to broadly work to strengthen battery material and mineral supply chains, including through working with tribal nations in the U.S.

The effort will include coordination with the Department of State and their work with partners abroad to strengthen mineral supply chains globally.