HIGHLAND HEIGHTS, Ky. — Northern Kentucky University is using money from the federal government to relieve more than half a million dollars in debt students accumulated during the COVID-19 pandemic.

For some students, it could be the difference between continuing their pursuit of a degree and dropping out.

What You Need To Know

- NKU is using federal money to help students affected by the pandemic

- The university is eliminating some student debt, providing bookstore vouchers, and investing in mental health

- One student said she thinks it could be the difference for some students in deciding whether to continue their education

- The university’s president hopes it will help with enrollment numbers

Senior Aliya Cannon holds "President of the Student Government Association" as one of her many titles on campus, and she doesn’t owe NKU a single dollar. She’s now one of many students who can say that.

“Money is always a big factor. Resources is always a big factor, especially for our students who pay out of pocket for school, and having to go home and work, and provide for our families and provide for the people at home, and kind of put our education on the back burner, it means a lot to have those resources so that we know, OK, I can get my foot back on the ground, I can get back strong and steady, and continue to do what I need to do so I can graduate with my degree here,” Cannon said.

The university received about $23 million from the American Rescue Plan Act. About half of that was to be used for student aid, and the other half for institutional purposes.

Within those institutional purposes, there was some flexibility to help students further, given financial burdens brought on by the pandemic.

“We thought, why not consider something really impactful for our students that would make a big difference?” NKU President Dr. Ashish Vaidya said. “We know that several of them are still thinking, 'Should we continue in school, or should we just go work?'"

NKU is using three million of those institutional dollars to convince students to stay in three ways.

- A $250,000 Investment in student mental health

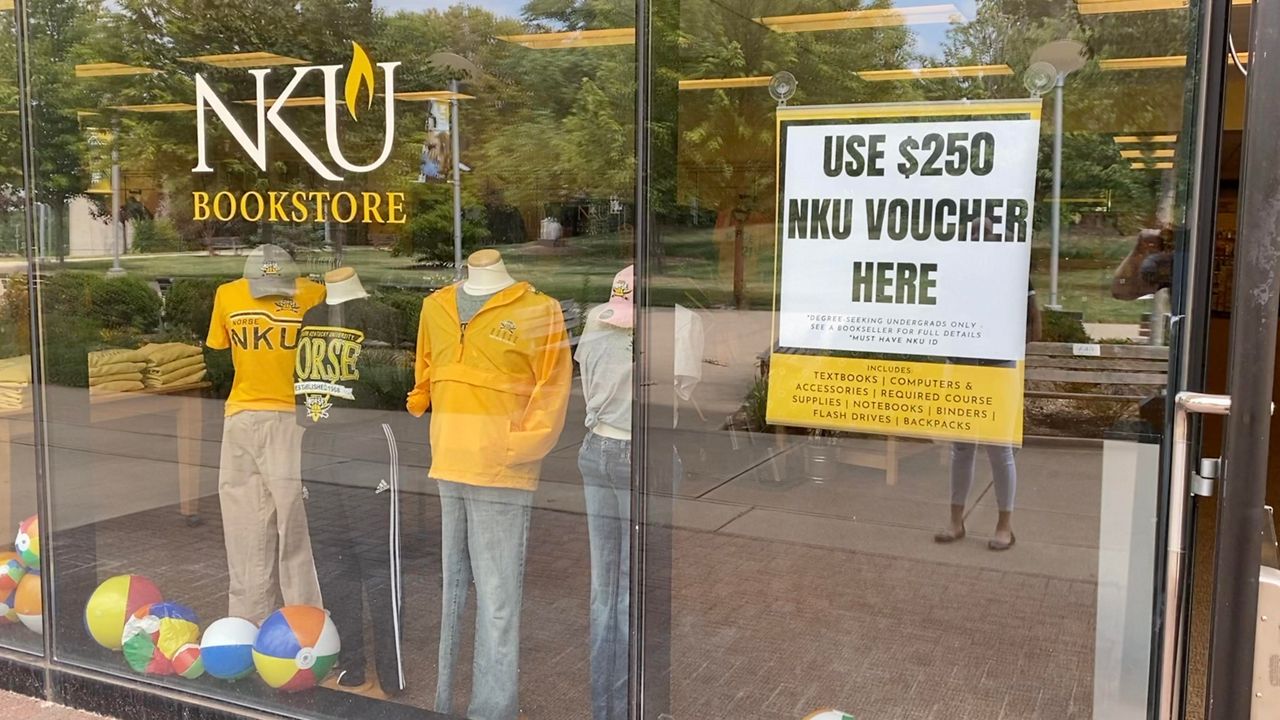

- $250 vouchers to the bookstore for every undergrad student

- Erasing $600,000 in debt students have accumulated since spring 2020

The debt doesn’t include things like federal and private student loans. What it does mean is that about 350 students will have their unpaid balances to NKU zeroed out. 85% of those students are undergrad.

Vaidya said, while the university is anticipating some decline in enrollment this fall, he hopes this will help incentivize more students to continue their education.

“Hopefully this will say, all right, let’s go back and begin with a fresh start, and complete the journey at NKU,” Vaidya said.

Cannon said she thinks it’s enough for many of her fellow students to reconsider putting a pause on college.

“This is benefiting our students a lot, because everyone has went through a trial or tribulation during COVID-19 and the pandemic,” she said. “And having that support, and knowing that we have those resources here at NKU is just a phenomenal experience and opportunity in itself.”