A new study has linked direct payments included in Congress’ various COVID-19 relief packages to a sharp decline in so-called “material hardships” for many people across the country.

The study, conducted by researchers Patrick Cooney and H. Luke Shaefer at the University of Michigan, used information from the U.S. Census Bureau’s regularly-published Household Pulse Survey, which the agency says contains the most accurate “data on the social and economic effects of coronavirus on American households.”

Researchers qualified “material hardships” into four specific categories: Insufficient access to food, financial instability, housing hardships and poor mental health.

According to the study, Americans reported a decrease across all categories following each of three direct payments included in coronavirus relief bills.

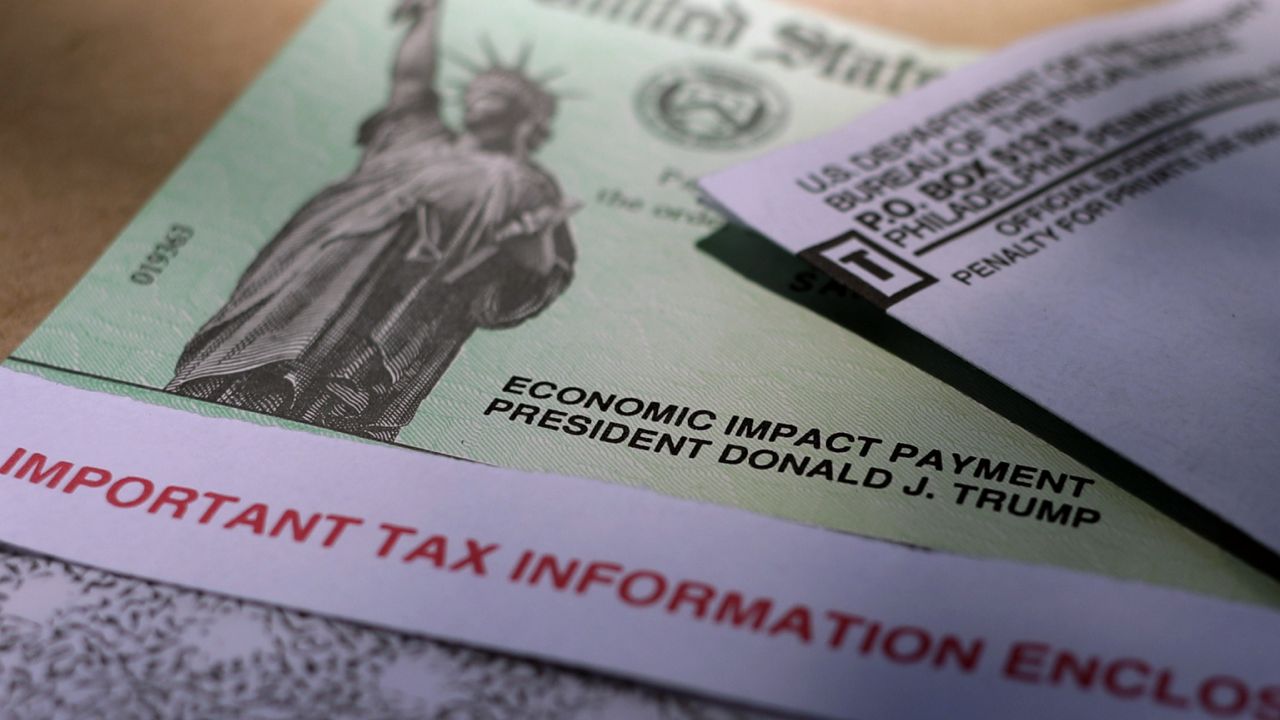

While checks were limited based on income, millions of Americans received a $1,200 payment from the March 2020 CARES Act, $600 from a subsequent package signed by Donald Trump in late December 2020, and an additional $1,400 from President Joe Biden’s American Rescue Plan, which was signed into law in March.

The findings illustrate a “fairly simple story,” researchers say, which is that throughout the course of the coronavirus pandemic, the “level of hardship faced by U.S. households can be directly linked to the federal government’s response.”

For example, food insecurity fell sharply both after the December package and the American Rescue Plan were passed, with the relief felt most significantly across families with children and those in lower income brackets.

Overall, the percentage of total respondents who said they often or sometimes did not have sufficient access to food for the previous seven days decreased from 13.7% to 10.7% between December 2020 and April 2021, and down again to 8.7% following the passage of the American Rescue Plan.

The portion of total respondents who reported a decrease in financial hardships — i.e., those who found it very difficult to pay for household expenses in a given week — similarly decreased after the direct payments.

Those numbers fell from a high of 17.8% in December, down to just 10% as of the beginning of May, which is the most recently-available data.

The state of individuals’ mental health may have been the most dramatically impacted by the direct payments.

When December’s COVID-19 relief package was passed, over 72% of respondents with children reported feeling nervous, anxious, or on edge for several or more days in the past week. That number decreased to 65% between December and the passage of the American Rescue Plan, and down again to 56% in May.

“The lack of support in November and December 2020, combined with a stalled economic recovery and rising COVID-19 infection rates, led to a marked increase in hardship at the end of 2020,” the study’s authors wrote in part. “Strong government support in December 2020 and March 2021, amidst a slow economic recovery, was followed by a dramatic decline in material hardship.”

Cooney and Shaefer believe there are a few reasons why the direct cash payments benefited so many Americans.

For starters, the checks were not limited solely to low-income families, as were many previous social programs; instead, the payments were “as broad-based as any federal income transfer support program ever implemented.” Because of their broad nature, the payments were likely used more widely throughout multiple sectors of the economy.

The flexible nature of the payments also benefited many Americans, per the study. Data shows households largely used the funds to pay for “food, housing, and other household expenses, as well as to pay down debt and get on stable financial footing as the economy rebounds.”