If you’re in the market for a Toyota, you may want to buy it sooner rather than later. The same goes for Honda, Subaru and Kia. All four brands make some of the most popular — and least available — vehicles on the market as President Donald Trump’s tariffs on foreign-made cars are set to take effect next week.

“Some brands may have a bit more cushion if production delays and disruptions occur in the coming weeks once tariffs are in place,” Cox Automotive Senior Economist Charlie Chesbrough said during a news briefing this week. “All brands’ existing inventory will have a significant cost advantage over future tariff production, so it is likely that prices today will rise for vehicles already in inventory to reflect this reality.”

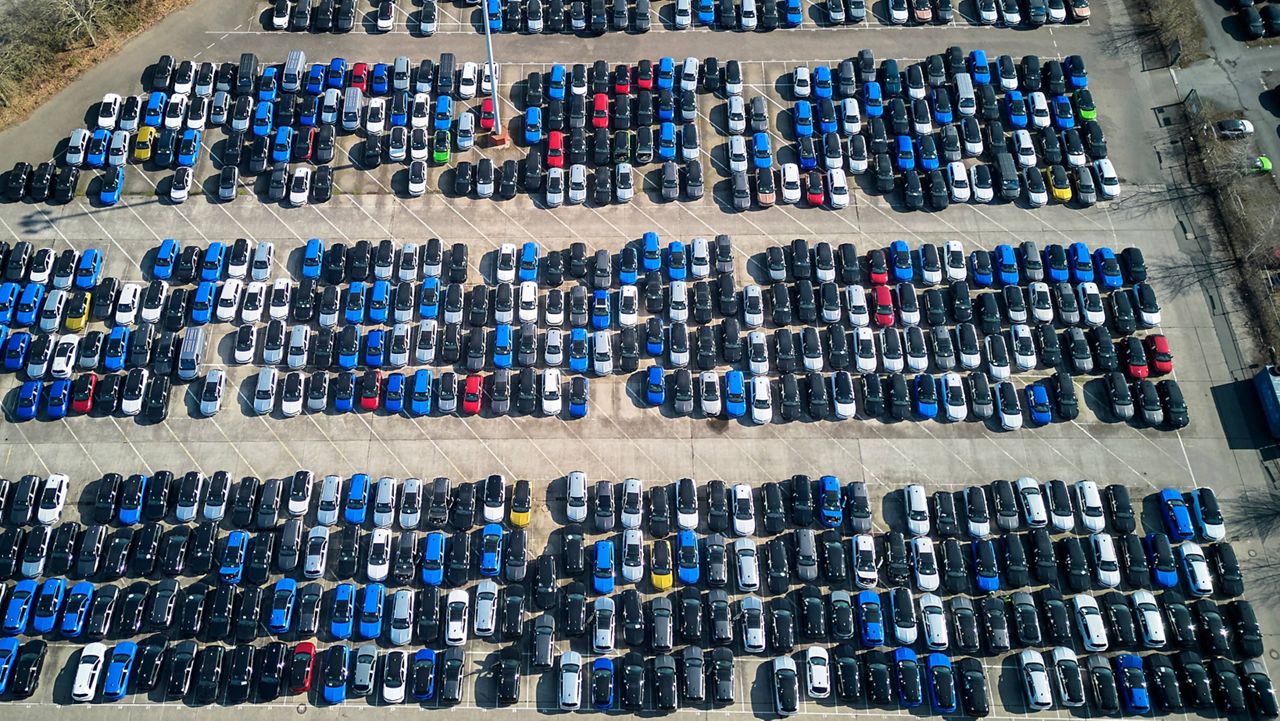

Toyota, which makes the popular RAV4 SUV and Toyota Camry and Corolla sedans, has less than 40 days of inventory on its lots. For Honda, whose bestsellers are the CR-V SUV and Civic sedan, supplies are less than 60 days. And Subaru, maker of the popular Crosstrek and Forester SUVs, has about two months of supply.

Ford, Mazda, Hyundai and Jeep have the most vehicle availability at present, with more than four months of inventory, according to Cox Automotive’s latest data.

Trump’s imposition of a 25% tax on steel and aluminum imports on March 12 and a 20% tax on all Chinese imports has increased vehicle prices by $300 to $500 so far. The tariffs on imported cars and parts scheduled to take effect next week could increase prices another $8,000 to $10,000 almost immediately, according to Cox.

The average transaction price for a new vehicle is already a near-record $48,039 — almost $10,000 more than in 2019 when the average price for a new vehicle was $38,363. Prior to the new tariffs taking effect, prices this year are shifting in dealerships’ favor as fewer manufacturers offer incentives.

“With higher values for existing inventories, incentives in decline and potential supply disruptions on the horizon, the new vehicle market is looking at a perfect storm for a return of inflation,” Chesbrough said.

In the short term, the new tariffs will result in lower production and less vehicle supply, further increasing prices. Longer term, not only will vehicle sales fall, but new and used prices will increase even more. And some models will be eliminated.