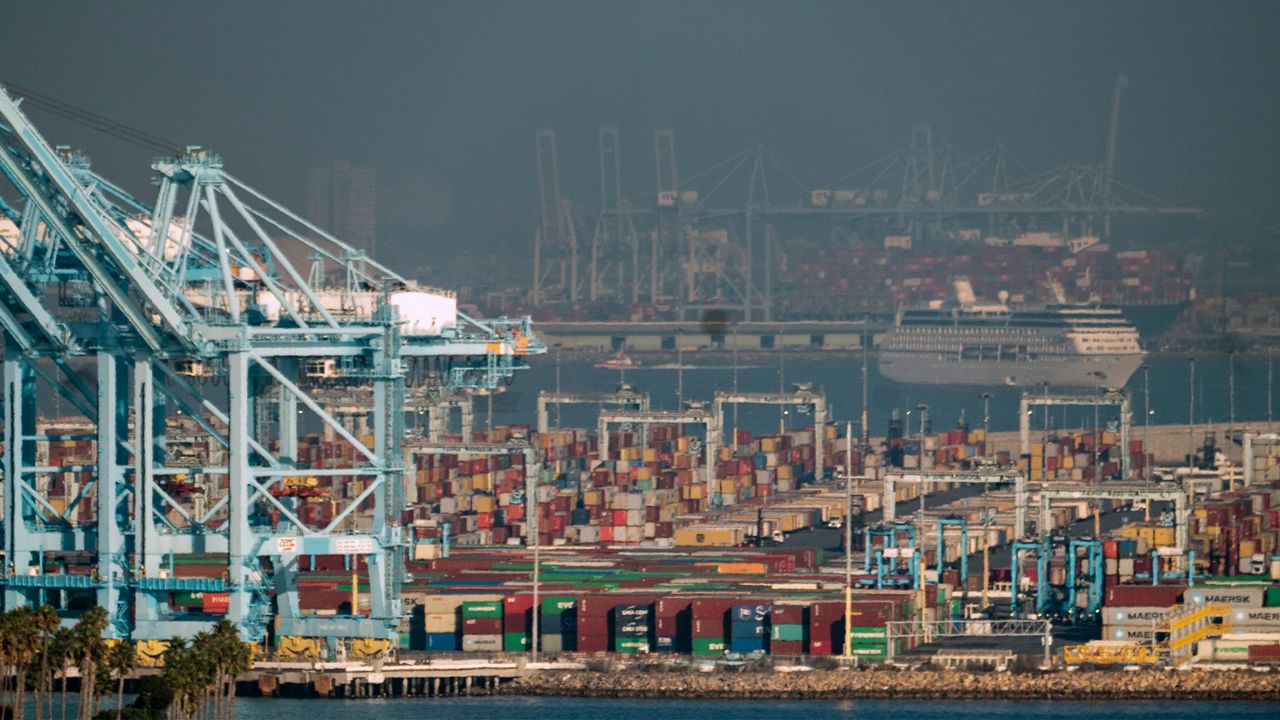

LOS ANGELES — Fewer ships are idling off the coast of San Pedro, and fewer empty containers are sitting on the docks, the Port of Los Angeles reported Thursday. Just 69 container ships are making their way across the Pacific today — the lowest number since October, according to Port of LA Executive Director Gene Seroka.

The Port also processed 21% more empty containers in January than it did one year earlier.

What’s helping the situation: Early Lunar New Year, which created a rush of cargo out of Asia before the holiday slowdown, as well as truckers, dockworkers and linemen returning to work following bouts with omicron, Seroka said.

"We're off to a strong start in 2022," Seroka said, adding that strong consumer demand is continuing to drive imports. The port recorded its best January ever, processing 3.5% more shipping containers last month compared with a year ago.

The amount of time empty shipping containers are sitting at the port has decreased to five days, down from a high of 11 days last October, and the amount of time containers linger before being loaded onto rail has dropped to two days from a peak of 13.5 days last summer.

Seroka said “much more work needs to be done to improve efficiency.”

More than half of the port’s available truck gates are not being used, nor is one third of its rail capacity.

“This is a multidimensional issue,” Seroka said, adding that some importers continue to use the port and containers for storage because there is not enough warehouse space or workers to transport and store cargo.

The slight dip in imports isn’t likely to last long. As we enter the second quarter, “retailers will be replenishing inventory,” Seroka said.

The ratio of inventory to sales is the lowest it has been since 2011, he said, “so most retailers have been trying to keep up with demand from American consumers.”