SAN DIEGO — Small businesses have faced incredible hardships during the COVID-19 pandemic, and more challenges are ahead in 2022.

The IRS is cracking down on payments received through apps, such as Cash App, Zelle or Paypal, to ensure those using the third-party payment networks are paying their fair share of taxes. This policy shift will mainly impact business owners using third-party payment network providers.

Payments of $600 or more for goods and services through a third-party payment network, such as Venmo, Cash App, or Zelle will now be reported to the IRS.

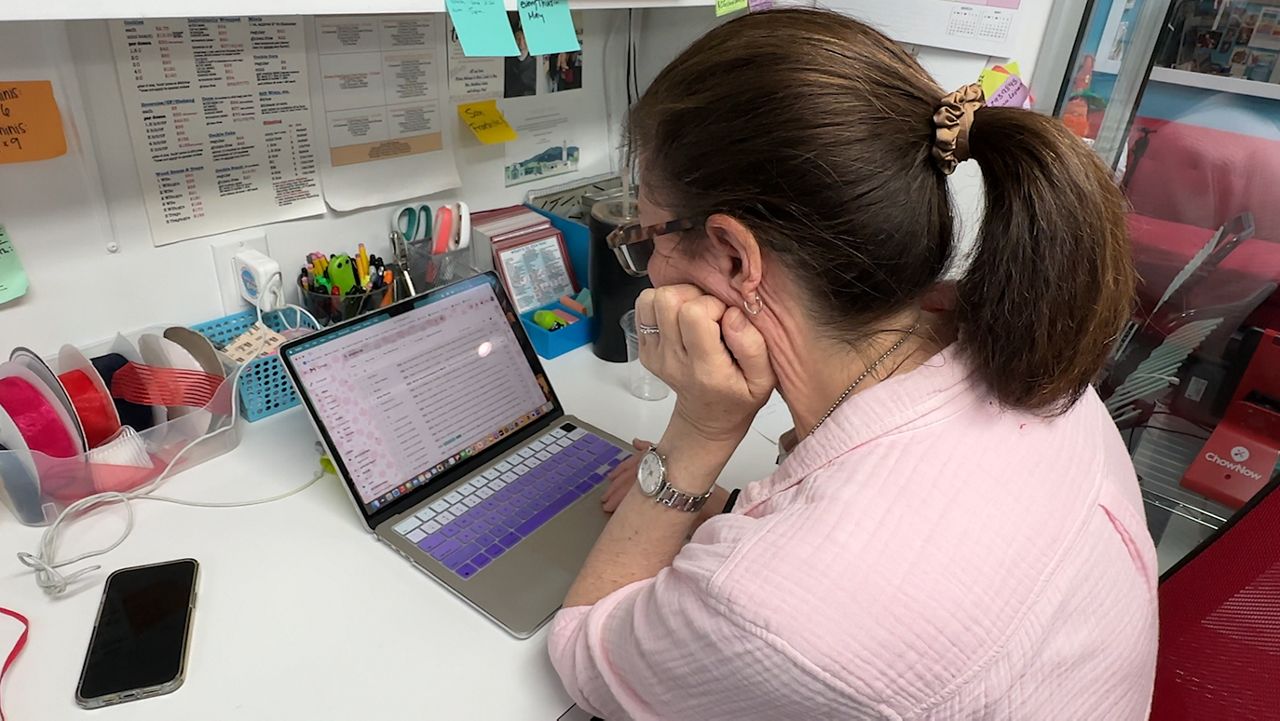

Brianna Sandoval is a professional hair stylist, makeup artist and cosmetologist who considers herself lucky to still be in business doing something that she loves.

"I think we got like the butt end of the joke when it came to, like, shutdowns, not even that it was a joke,” she said. “We really got screwed. I don’t think people realize how bad it was for us."

The third-party payment networks made business easier during a time when doing business was hard.

“Now they’re doing this Venmo stuff, it’s like they just want to keep taking money,” Sandoval said with a laugh. “Some of the side stuff or, like, family or friends are paying me for their hair, or a client bought some product and so they need to pay a little extra. I would have them send it to me on Venmo, or, say my card reader wasn’t working, Venmo was a great way of doing it. And then you wouldn’t have to always claim some of that stuff because it was kind of snicklefritz compared to what you’re actually making.”

Beginning Jan. 1, 2022, third-party payment networks will be required to send users Form 1099-K for transactions made, by mail or electronically. The new tax reporting requirement will impact 2022 tax returns filed in 2023.

Dr. Steven Gill, associate professor of accounting at the Fowler College of Business at San Diego State University, says the new law doesn’t apply to personal transactions.

“Say, for example, you split a dinner with a friend of yours, and she just Venmo'd you the amount," Gill said. "You don’t have to include that, of course, as part of your taxable income.”

Gill recommends deducting business expenses and separating personal and business accounts. He added that it’s unlikely the IRS will take a heavy-handed approach and audit everyone the first year this is enacted.

"For small businesses, there’s no reason to panic," he said. “This will be a little bit of a learning year for everyone, and over time we can expect the IRS to use the information on 1099-K's. That’s the reason they expanded them to begin with, in order to try to identify tax payers who really might not be reporting all their income."

The tax change is just another challenge Sandoval will figure out as she keeps doing what she loves.

“Always have a plan B, or C, or D, or E, or F,” she said with a laugh.

Gill says the new tax rule will be a good motivator for everyone to get their books in order, but he also recommends hiring a tax expert if you start to feel overwhelmed.

“Just to be on the safe side, it might be in your best interest to create a personal account, create a separate business account," he said. "And that way, you know you’ve kept those amounts separately, and you don’t have to worry about reconciling those differences at the year end.”