The Biden administration spent Monday spreading the word — and asking others to help do the same — about the newly expanded child tax credit.

What You Need To Know

- Monday is Child Tax Credit Awareness Day, a White House effort to spread the word about the newly expanded child tax credit

- In Pittsburgh, Vice President Kamala Harris and Labor Secretary Marty Walsh spoke about the credit and asked the audience to make sure others know about it

- The tax credit, expanded the American Rescue Plan, raises the credit this year from $2,000 per child to $3,000 for kids ages 6 to 17, and $3,600 for children under 6 for most families

- Anyone who did not file a tax return in 2019 or 2020 or register to receive a stimulus check must sign up at ChildTaxCredit.gov to receive monthly tax credit payments

The White House declared it Child Tax Credit Awareness Day, as organizations that advocate for children, faith-based groups and elected officials to held events, announced strategies for signing up low-income families and hitting social media to explain how it works.

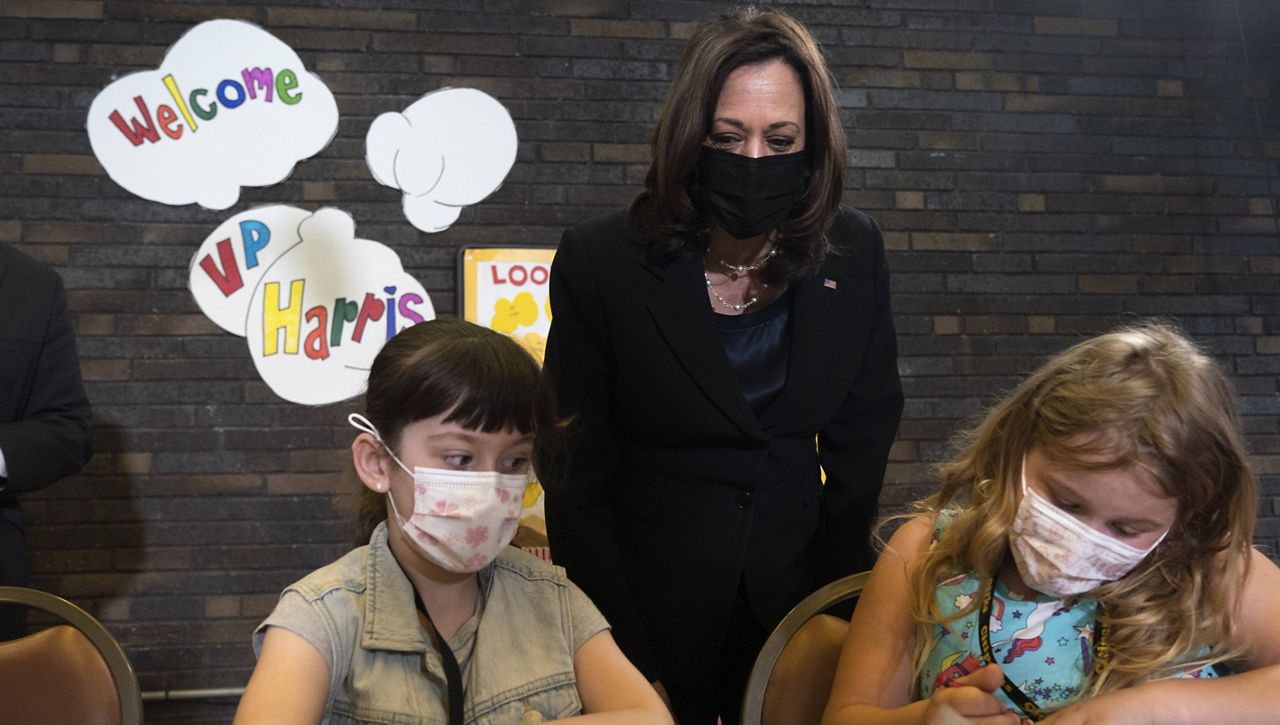

In Pittsburgh, Vice President Kamala Harris and Labor Secretary Marty Walsh visited the Brookline Recreation Center, meeting and chatting with teachers and campers ages 7 to 12.

In a speech to an audience moments later, Harris urged people to do their parts to make sure others take advantage of the child tax credit.

“We need your help. Whether you are spending some time over the next couple of days at the grocery store or at work or at school or church — wherever you run into people, perfect strangers — just go on up and introduce yourself. Tell them about the child tax credit,” Harris said, laughing.

The tax credit was expanded under President Joe Biden’s $1.9 trillion COVID-19 relief package, also known as the American Rescue Plan. It raises the credit this year from $2,000 per child to $3,000 for kids ages 6 to 17, and $3,600 for children under 6.

“That could cover a month of rent, a few months of groceries, an entire year of diapers, right?” Harris said. “So it makes a big difference.”

Also new is that, rather than receiving the entire credit after filing taxes next year, parents will receive half of it in the form of monthly payments from July through the end of 2021.

The full credit is available to all families earning up to $150,000 a year, including those with low or no income. Families with high incomes may receive a smaller credit or may not qualify for the credit at all.

Any family who filed a tax return in 2019 or 2020 or registered to receive a stimulus check during the pandemic will automatically begin to receive the monthly payments. Anyone else who is eligible must sign up at ChildTaxCredit.gov.

The Biden administration expects the American Rescue Plan to cut in half the number of children living in poverty.

“This tax cut will give our nation’s hardworking families with children a little more breathing room when it comes to putting food on the table, paying the bills, and making ends meet,” Biden said in a statement Monday. “Nearly every working family with children is going to feel this tax cut make a difference in their lives, and we need to spread the word so that all eligible families get the full credit.”

Harris said the impact the American Rescue Plan will have on families will be “seismic” and “historic.”

Biden’s American Families Plan, meanwhile, seeks to make the expanded child tax credit permanent.

“We've seen big corporations and the wealthiest Americans get huge tax breaks over the last several years,” Walsh said Monday. “Isn't it time that we make tax code for working families law in this country?”