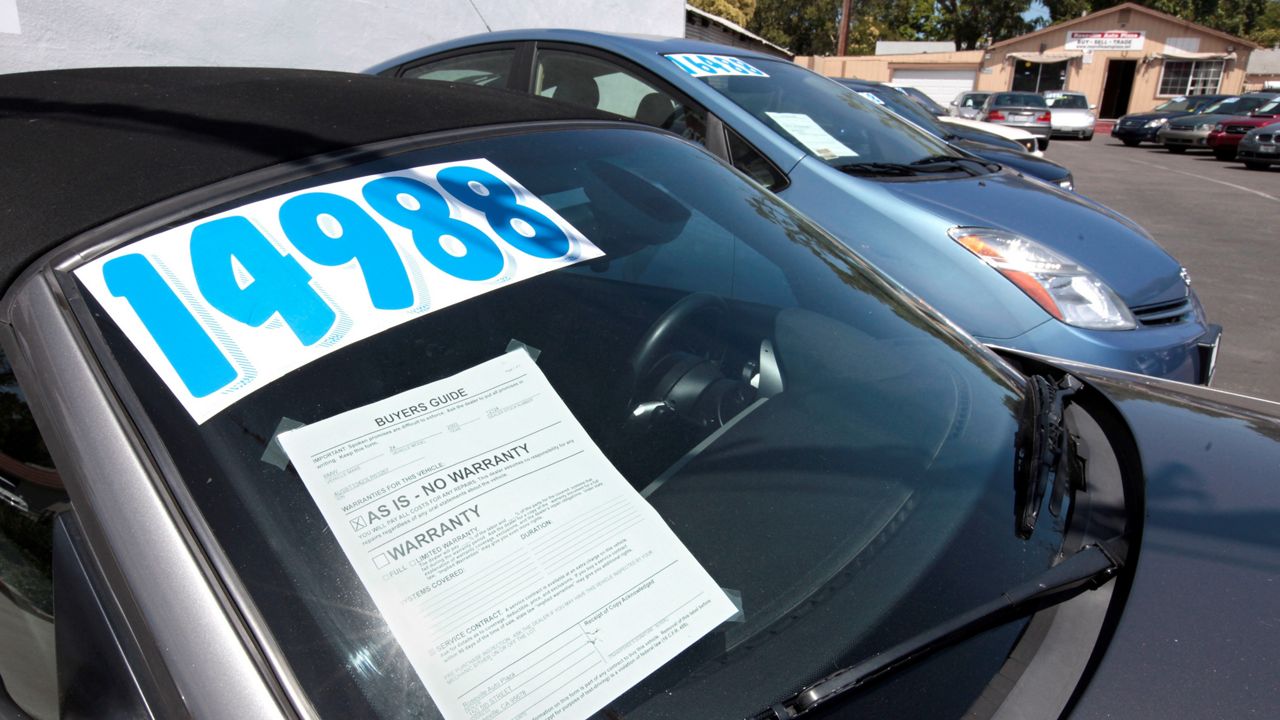

The "new normal" is turning out to be anything but for used car prices. What was once a classic depreciating asset, losing value as a vehicle racked up years and logged more miles, has increased in value.

Used car prices are up 6.6% since the start of the year, from an average of $22,522 in January to $24,009 today, according to the automotive search engine, iSeeCars.com.

"Unprecedented" has become an overused word in the 14 months since the World Health Organization declared COVID-19 a pandemic, altering life on so many levels, "but it's not out of place here. We've got used car values higher than we've ever seen them. We've got stories of people who bought a used truck or SUV a year ago that are worth more now," said iSeeCars.com's executive analyst, Karl Brauer. "Cars are a depreciating asset — at least they're supposed to be — but they haven't been for certain people."

A 2018 Ford F-150 XL that listed for $27,000 a year ago is now up 25.4% and selling for $34,000, while a 2019 Nissan Rogue SV that listed for $17,000 last May is up 17.3% to $21,000, Brauer said.

A lack of new cars is partially to blame. New car inventory fell 16.6% from the first week of April to the first week of May, according to iSeeCars.

"What we are seeing is the laws of economics play out," said Michelle Krebs, executive analyst with Cox Automotive. "We have extremely strong consumer demand, we have extremely low inventories of new and used vehicles, and that causes prices to soar."

Krebs said the roots of today's record prices for used vehicles started with the pandemic last March, when car companies temporarily shut their factories, anticipating a recession that would slow new vehicle purchases. Fearing a protracted sales slump that never happened, they canceled supply orders from chip makers, who started selling them for video games, phones, computers and other COVID-inspired, in-demand products.

Now that they want chips again, there isn't enough to go around. One of their leading makers, Taiwan Semiconductor Manufacturing Co., said it would take until the end of June to catch up with demand.

The chip shortage is putting pressure on new car prices and how much consumers are willing to pay for them, which, in turn, affects used car prices. According to a new Cox Automotive consumer poll, more than 40% of car shoppers are willing to pay up to 12% over the sticker price for a new vehicle, but the reverse is also true. Many customers who had been in the market for a new vehicle are now looking at used.

"When there's a shortage of new cars, people who were going to buy a new car that can't find what they want, buy a one- or two-year-old used model instead," said Toby Russell, co-founder and co-CEO of Shift.com, an online used car marketplace based in Whittier.

New car buyers vying for the same cars as used car buyers put upward price pressure on pre-owned products. Since last spring, the problem has been building when stay-at-home orders prevented the auctions that many dealers rely upon to source used cars, and many dealerships were also closed, preventing consumers from trading in their old vehicles.

Banks were also providing forbearance to consumers who may have otherwise defaulted on their loans, stopping repossessions that also contribute to used car inventory.

With vaccinations on the upswing and COVID-19 restrictions on the wane, consumers in the market to buy a car and hit the road are finding there aren't that many to choose from and that they have to compete with more buyers, including rental car companies and dealerships.

Rental car companies typically sell their used vehicles at auction once they've racked up too many miles, but because so many of them offloaded their fleets last year when no one was traveling, they are now looking to buy cars from the same sources as everyone else to meet surging demand for travel. Dealers, too, are scrambling for used vehicles after months without sufficient trade-ins to meet current demand.

"What we're seeing right now is the true meaning of extraordinary," Russell said. "It's highly unusual."

Until February, used cars were depreciating as expected, at the rate of 1 to 2% per week, but the reverse started happening in late February, with cars increasing in value by 1 to 2% per week, then 3 to 4% per week by late March. Used car prices are currently appreciating at 2 to 3% per week, Russell said.

For a company like Shift, which buys and sells used cars directly to and from consumers, the situation "has worked out quite positively," said Russell, adding that activity on the Shift.com website and app are both up. In California, used EVs and plug-in hybrid electric vehicles are especially popular right now, along with midsize and full-size SUVs for road trips, he said.

With used car pricing at its peak, "the question is if it's going to be a steep or steady return to normal," said Russell, who anticipates a rise in demand through summer and a leveling off in the fall. "We've just seen the crescendo, and that will hang for a bit, but that rapid appreciation and super high escalation of prices will start leveling off."